Mortgage Prepayment

Making a

prepayment?

Learn more about your options by exploring the most frequently asked questions about mortgage prepayments.

Understanding Mortgage Types

Expand Fixed Interest Rate or Variable Interest Rate

Fixed Interest Rate

- Your interest rate will not change throughout the entire term of your mortgage.

- You'll always know exactly how much your payments will be and how much of your mortgage will be paid off at the end of your term.

Variable Interest Rate

- Your interest rate may fluctuate from time to time because it changes when the TD Mortgage Prime Rate changes.

- If your interest rate decreases, your payment amount remains the same, but more of your mortgage payment is applied to the principal balance owing.

- If your interest rate rises, your payment amount remains the same, but more of your monthly payment will go toward interest.

- At certain times, you may be required to revise your payment arrangements. Please ask us for details.

Expand Open or Closed

Open Mortgage

- Requires you to make set payments at set times but also lets you pay any amount toward your mortgage at any time, without having to pay a prepayment charge for doing so.

- Interest rates are typically higher for this type of mortgage.

Closed Mortgage

- Requires you to make set payments at set times and pay prepayment charges if you want to pay more than allowed, renegotiate or refinance your mortgage before the end of your term.

- Interest rates are typically lower for this type of mortgage.

Expand Long Term or Short Term

Long Term

- A long term mortgage is generally for three years or more.

- A long term mortgage is often the best choice when you are comfortable with the interest rate and you want the security of budgeting for the future.

Short Term

- A short term mortgage is usually for two years or less.

- A short term mortgage is a good option if you believe interest rates will drop by your maturity date.

Expand Home Equity Line of Credit

TD Home Equity FlexLine offers the convenience and flexibility of:

Revolving Portion

- Get a variable interest rate that changes with TD Prime Rate.

- Prepay your principal balance in the Revolving Portion with no prepayment charges; as you pay down your outstanding balance, your available credit increases up to your credit limit.

- Apply once – you can access your available credit within your credit limit anytime without having to re-apply1.

- Pay at your own pace – make monthly interest-only payments or pay as much as you want2.

- Establish regular payments to your outstanding balance by setting up a Term Portion (subject to minimum amounts) or by choosing fixed payments on your Revolving Portion.

Term Portion

- Pay off all or a portion of your outstanding balance by establishing regular payments through a Term Portion. Choose between a fixed or variable interest rate, and open or closed-to-prepayment term, depending on the rate you have chosen.

- If you choose a Term Portion – Fixed Rate, your interest rate will not change for that part of your outstanding balance for the duration of your term. If you choose a Term Portion – Variable Rate, your interest rate will fluctuate with changes to TD Prime Rate.

- Whether you choose a fixed or variable interest rate, making regular payments through a Term Portion will provide the stability of periodic payments towards reducing your outstanding balance.

1 Subject to the terms of your TD Home Equity FlexLine Agreement.

2 Available on the Revolving Portion only.

Expand Can I prepay without paying a prepayment charge?

Your prepayment charge will depend on what type of mortgage you choose.

For Open Mortgages:

- You will not have to pay a prepayment charge if you decide to pay off your mortgage before the Maturity Date.

For Closed Variable Interest Rate Mortgages:

- If you decide to pay off your mortgage before the mortgage term ends (the Maturity Date), or to pay an amount greater than your allowable prepayment privileges, you may have to pay a prepayment charge.

- The prepayment charge is calculated as 3 months' interest.

For Closed Fixed Interest Rate Mortgages or TD Home Equity FlexLines with a Fixed Rate Portion:

- If you decide to pay off your mortgage before the mortgage term ends (the Maturity Date), or to pay an amount greater than your allowable prepayment privileges, you may have to pay a prepayment charge.

- The prepayment charge is the greater of 3 months' interest or an Interest Rate Differential (IRD) amount.

The IRD amount is equivalent to the difference between your annual interest rate and the posted interest rate on a mortgage that is closest to the remainder of the term less any rate discount you received, multiplied by the amount being prepaid, and multiplied by the time that is remaining on the term (see below for some examples).

Prepayments

- Make one or more prepayments up to 15% of your original principal every year.

Increase your payment amount

- Increase your payment amount by up to 100% of your original regular mortgage or fixed rate portion payment.

Increase your payment frequency

- Switch to rapid weekly or rapid bi-weekly payments and make up to an extra month's payment every year.

Expand How can I avoid paying prepayment charges altogether?

Whether you're paying off your mortgage in full because you are moving, or simply paying down your principal sooner, your TD mortgage gives you a number of options for prepaying without paying prepayment charges.

Portability Plus

- Take your current mortgage interest rate and term with you to your new home – and avoid prepayment charges for paying off your mortgage before the Maturity Date (does not apply to Home Equity Lines of Credit with a fixed rate portion).

Make prepayments within your privileged amount

- Make one or more prepayments up to a total of 15% of the original principal every year.

Choose an open mortgage

- Pay any amount toward your mortgage at any time, without having to pay a prepayment charge for doing so.

Expand Can I reduce my prepayment charges?

There are a number of ways to reduce prepayment charges when paying off a mortgage or TD Home Equity FlexLine with a fixed rate portion.

In many cases, you can reduce the prepayment charges that may be applicable when you payout and reduce the amount of interest you pay over time. Some examples of how you can achieve this are:

- Over the term, increase your monthly payment by up to 100% of the original regular mortgage or fixed rate portion payment

- Each calendar year, make one or more lump-sum payments of up to 15% of the original principal amount

- Change your payment frequency to a more frequent payment schedule

By reducing the principal balance of your mortgage or fixed rate portion, you will reduce the balance on which the Interest Rate Differential (IRD) or 3 months' interest is calculated.

Expand How are prepayment charges calculated?

Although it can sometimes seem confusing, TD uses a precise formula to calculate any prepayment charges you may be required to pay.

For a closed variable rate mortgage your prepayment charge is 3 months' interest (90 days), calculated on your remaining mortgage balance on the date of prepayment.

For closed fixed rate mortgages or TD Home Equity FlexLines with a fixed rate portion, your prepayment charges for the mortgage or the fixed rate portion will be the greater of:

The difference between your annual interest rate and the posted interest rate on a mortgage that is closest to the remainder of your term, less any rate discount you received, multiplied by the amount being prepaid, and multiplied by the time that is remaining on the term.

3 months' interest (90 days) or the Interest Rate Differential Amount

How to estimate Three Months' Interest (90 days)

|

Step 1: ________ (A) |

The amount you want to prepay |

|

Step 2: ________ (B) |

Your current annual interest rate expressed as a decimal (for example, 6.75% = .0675) |

|

Step 3: ________ (C) |

A x B = C |

|

Step 4: ________ (D) |

C ÷ 4 = D |

How to estimate the Interest Rate Differential Amount

|

Step 1: ________ (A) |

Your current annual interest rate expressed as a decimal (for example, 6.75% = .0675) |

||||||||||||||||||||

|

Step 2: ________ (B) |

The posted interest rate for a Similar Mortgage, less any rate discount received by you under the Mortgage

How to choose the right term and corresponding interest rate for your calculation |

||||||||||||||||||||

|

Step 3: ________ (C) |

A - B = C, which is the difference between your current annual interest rate and the interest rate in B above (write C as a decimal) |

||||||||||||||||||||

|

Step 4: ________ (D) |

The amount you want to prepay |

||||||||||||||||||||

|

Step 5: ________ (E) |

The number of months remaining on the term of your Current Mortgage |

||||||||||||||||||||

|

Step 6: ________ (F) |

(C x D x E) ÷ 12 = F F = Your estimated Interest Rate Differential amount |

Payment timing and interest

Payment timing, payment amount and interest rate changes can have a big impact on your IRD amount calculation. Use the prepayment calculator to see how changes can impact your prepayment charges.

Expand When would I have to pay a charge?

| Scenario | What will it cost? | To avoid the fee |

|---|---|---|

|

Paying more than your prepayment privileges allow |

The greater of: |

Track the value of your annual prepayments carefully to ensure they don't exceed 15% of the original principal amount every year. |

|

Refinancing (increasing your borrowing amount) before the Maturity Date |

The greater of: |

When selecting your mortgage options, consider choosing an open or short term mortgage if you think you might want to refinance at some point in the near future. |

|

Transferring your mortgage to another lender before the end of your term |

The greater of: |

Consider choosing an open or short term mortgage if you think you might wish to transfer your mortgage to another lender at some point in the near future. |

Are there any other fees when paying off or paying down my mortgage or home equity line of credit with a fixed rate portion?

If you prepay your mortgage in full, other fees may apply.

Other fees

Reinvestment Fee

- If you prepay your mortgage in full during the first term (i.e. you never renewed your mortgage)

Mortgage Discharge Fee

- This is an administration fee for preparing the discharge request

Mortgage Assignment Fee

- This applies if you request to assign your mortgage to another financial institution, rather than a discharge

Cashback Reimbursement

- If you received a cashback payment in connection with your mortgage, you may be required to reimburse a proportionate amount. This applies in the following situations:

- You prepay the mortgage in full

- We assign the mortgage to another lender at your request

- You renew the mortgage and that renewal is effective before the maturity date of your current mortgage term

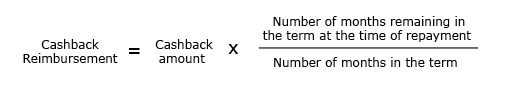

The amount of the Cashback Reimbursement is calculated as follows:

Administration Fee for Open Variable Interest Rate Mortgages

- This is an administration fee that is charged if you prepay your mortgage in full:

- first year = $500

- second year = $250

- after two years = $0

Get Pre-Approved

You pick the time and we'll contact you.

Visit a branch at a time that's convenient to you.

Find a Mortgage Specialist that's close to you and request a meeting.

For complete details on additional fees, talk with your TD Canada Trust branch today or call us at 1-800-281-8031.

Legal

Applies to TD Canada Trust mortgages. If your mortgage is with TD Financing Services ("TDFS"), please consider the information provided above as a guideline only. Certain terms referenced above, including rate discounts, open mortgages, 100% increases in payment amounts and cashback reimbursements, are not applicable to TDFS mortgages. If you have any questions regarding prepayment options in respect of your TDFS mortgage, please contact us at 1 877 273 7498.