TD MySpend app

Stay on top of your spending

The TD MySpend companion app is the perfect addition to your TD app. To use TD MySpend, the TD app must also be installed on your device. Then, you can keep track of your monthly spending and help improve your spending habits!

Easy to Set-Up and Use

TD MySpend securely connects to your eligible TD Accounts. TD automatically tracks your transactions and categorizes them for you. No need to enter expenses, or manually link your TD Accounts.

Real-time Notifications

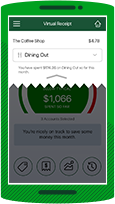

Get real-time notifications and digital virtual receipts every time there is a transaction in an eligible category. That way, you can keep an eye on your spending.

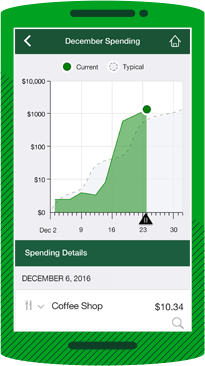

Track Your Spending over Time

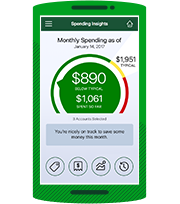

Use the Spending Insights Meter to help you keep track of how you’re doing compared to your typical monthly spend. You will be able to access your Spending History (up to the previous 12 months), so you can see exactly where your money went.

Everything else you need to know:

TD MySpend is a smart, easy-to-use TD app for iOS (iPhone) and Android™ Smartphones that helps you monitor your spending from your TD Canadian dollar personal banking accounts and credit card accounts. As a unique money management tool, TD MySpend can help you make informed spending choices and find ways to save.

TD MySpend can track where you spend and how much you spend by category (groceries, health, etc.) from your chosen TD chequing, savings and credit card accounts. And because it compares your current spending to your monthly average, you will know if you are spending more, less or about the same as you typically do.

Expand How does TD MySpend work?

TD MySpend for iPhone and AndroidTM works with the latest version of the TD app for smartphone. All you need is the TD app installed first, a valid EasyWeb login ID, and at least one eligible TD Canadian dollar personal banking account or credit card account.

Once you install TD MySpend and complete your enrollment, your eligible TD personal banking accounts and credit card accounts will be automatically turned on and ready to use. You can disable any account you do not want to track and display in TD MySpend by going to Preferences and turning it off. You can turn it back on for TD MySpend at any time.

When you make a purchase using a TD personal chequing, savings or credit card account, you will receive a transaction notification on your phone. After each transaction, TD MySpend compares your current spending to your monthly average (your typical spending), so you know if your spending is above typical, below typical, or about the same.

Expand Will I be automatically enrolled in TD MySpend?

You won’t be automatically enrolled in TD MySpend but it only takes these few steps to get started:

- Download the TD app for iOS (iPhone) or AndroidTM.

- Select TD MySpend from the TD app main menu.

- Review the feature screens then tap Get Started.

- Login to the TD app with your EasyWeb login ID and password.

- Read and Accept the Privacy Terms and TD MySpend Terms & Conditions.

- Tap on Get TD MySpend (iPhone) for the App Store or Download TD MySpend (Android) for Google Play.

Expand What accounts are eligible?

You can use your TD Canadian dollar personal chequing, savings and credit card accounts to track and display your spending in TD MySpend.

Expand What are the customer eligibility requirements?

To be eligible to use TD MySpend all your TD accounts must be in good standing.

Eligible accounts include TD Canadian dollar personal chequing, savings and credit card accounts.

Expand Will TD Credit Card Authorized Users be able to view account activity in TD MySpend?

Yes. Authorized Users who have registered for TD MySpend will be able to view all TD credit card transactions by both the Primary Cardholder and other Authorized Users.

If you do not want to include spending from your shared TD credit card account in TD MySpend, you can go to TD MySpend Preferences and disable it.

Please note: If you use TD MySpend Preferences to disable a TD credit card account that has Authorized Users, those Authorized Users who have registered for TD MySpend can continue to track credit card spending and view transactions (including yours if you are the Primary Cardholder). Transactions by Authorized Users will still be included in the spending meter and average monthly spending. If you don't want these transactions included, all Authorized Users must disable the credit card in TD MySpend Preferences.

Expand How will my personal banking joint account info display?

If you have a joint account you will see all transactions on the account in TD MySpend. Because TD MySpend tracks accounts and not individual users, transactions by all account holders are included in the spending meter and monthly spending average.

If you do not want to include your joint account spending in TD MySpend, you can go to Preferences and turn it off.

Please note: If you use Preferences to disable a joint account, those account holders who have registered for TD MySpend can still track spending from the account in TD MySpend and view all transactions (including yours). All transactions will still be included in the spending meter and average monthly spending. If you don't want these transactions included, all account holders must disable the account in Preferences.

Expand What are the spending meter and the money path (spending graph)?

The spending meter (Spending Insights screen) provides a snapshot of how you are spending compared to your monthly average. Green indicates that you are spending below typical, yellow is typical and red is above typical.

The money path (spending graph) gives you a day to day view of your overall spending for the current month. It’s also displayed against your average monthly spending trend so you can quickly compare if you’re spending more, less or about the same as usual. You can use the slider at the bottom of the chart to see transactions for the selected period up to the current date.

Please note that when you close a virtual receipt that appears on your mobile device prior to login, the Spending Insights screen will be shown.

Expand What does the category spending screen mean for me?

To view your category level spend you can go to the Spending by category screen. It shows how much you've spent in each category and if you are above, at, or below typical (red, yellow, or green).

The bar chart on the screen displays total amount spent by category from highest to lowest from left to right.

For more insight on each category of spend select that category bar in the chart.

Expand How are my transactions categorized?

TD MySpend automatically places your transactions into categories, which are grouped under Wants, Needs or Other.

Wants

Discretionary or optional spending categories, such as Dining Out, Shopping, Travel and Entertainment, are grouped under Wants.

Needs

Categories related to your living expenses such as Home, Groceries, Transportation, Utilities, Education and Health are grouped under Needs.

Other

Transaction categories that are not clearly defined as a Want or a Need, including Gifts, Donations and Taxes, are grouped under Other.

You can move a transaction to a different category at any time.

- Find the transaction under Spent by Month, Spent by Category or Transaction History.

- When you see the transaction, just tap the category icon next to it. This will open the Change Category overlay.

- Then tap your preferred category and your transaction will be moved.

Expand What type of transaction notifications or receipts will I receive?

You will receive a transaction notification as well as a digital virtual receipt on your smartphone shortly after making a purchase using an account you have turned on in TD MySpend. You can view your digital virtual receipt by tapping on the transaction notification.

You will need to have Notifications turned on for TD MySpend to receive and view transaction notifications and virtual receipts. You can also turn off Notifications in Preferences.

Please note: The digital virtual receipt is a transaction record generated by the TD MySpend. It is not a receipt from the merchant.

Also note that a transaction notification or a digital virtual receipt may be visible on your mobile device before you login to TD MySpend.

Expand What is a virtual receipt?

TD MySpend will provide you with a digital virtual receipt for purchases you make from the TD accounts turned on in TD MySpend. The receipt is a transaction record generated by TD MySpend and is not a receipt from the merchant.

You will need to have Notifications turned on for TD MySpend to receive and view transaction notifications and virtual receipts. You can also turn off Notifications in Preferences.

If you receive a TD MySpend notification for a purchase that you or an authorized account user did not make, you should report it by calling us at 1-866-222-3456.

Expand Do I get a virtual receipt for all of my transactions?

You will receive a digital virtual receipt for most of your transactions. There are some transaction types and account activities that do not generate a digital virtual receipt, such as account fees and transfers between your accounts. The receipt is a transaction record generated by TD MySpend and is not a receipt from the merchant.

You will need to have Notifications turned on for TD MySpend to receive and view transaction notifications and digital virtual receipts. You can also turn off Notifications in Preferences.

If you receive a TD MySpend notification for a purchase that you or an authorized account user did not make, you should report it by calling us at 1-866-222-3456.

Frequently asked questions

The TD app and the TD MySpend app are free to download, however standard wireless carrier message and data rates may apply.

All trade-marks are the property of their respective owners.

Apple, the Apple logo, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

TM Google Play is a trade-mark of Google Inc.