TD Mobile Deposit

Deposit cheques

in a snap with

TD Mobile Deposit

TD Mobile Deposit always fits your schedule

The TD app allows you to manage your money by depositing cheques as soon as you

receive them so you can spend more time doing the things you want, like catching up with

friends at lunch or taking a long run after work.

How it works

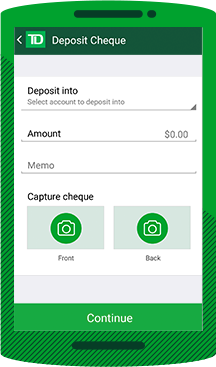

First, register for TD Mobile Deposit, then make deposits in 3 easy steps:

Step 1:

Login to the TD app, select the account and enter the amount.

Step 2:

Take a photo of the front and back of the completed cheque.

Step3 :

Check the details of your deposit and Submit.

You will be able to view how much is available for immediate use before you complete your deposit.

For details on how to complete and deposit your cheque, visit our FAQ.

What do I need to get started?

You have the latest version of the TD app

You have the latest version of the TD app  You have at least one eligible Personal or Business Chequing or Savings Account

You have at least one eligible Personal or Business Chequing or Savings Account

For more details, please visit Frequently Asked Questions

Make deposits with confidence

After your deposit is complete, you'll receive a

confirmation:

- On the TD Mobile Deposit Receipts screen for 30 days in the app

- In your EasyWeb Secure Messaging inbox for 6 months

Frequently Asked Questions

Expand Is TD Mobile Deposit secure?

Yes, TD Canada Trust offers extensive security features to ensure that you can deposit cheques in a safe and private mobile environment.

In addition, TD Mobile Deposit cheque images are never stored on your smartphone or tablet. For more information, visit our Mobile Apps Privacy Code.

Expand Am I eligible to use TD Mobile Deposit?

All Customers:

- You must have a smartphone or tablet with a rear-facing camera and the latest version of the TD app is recommended.

- You must have a minimum iOS 8.0+ or Android 4.1.x+ version on your device in order to use TD Mobile Deposit.

For Personal Bank Accounts:

- You must have at least one eligible Chequing, Savings, or Line of Credit account. A Tax-Free Savings Account (TFSA) is not eligible.

- You alone are authorized to sign for the business and you are either a sole proprietor or the sole shareholder of a corporation.

- You have a "Full Access" TD Access Card for the business

- Your business has one of the following accounts:

- Business Chequing Account

- Business Savings Account

- U.S. Dollar Business Chequing Account

For Business Banking Customers:

Expand Is my device compatible with TD Mobile Deposit?

First, you must have a smartphone or tablet with a rear-facing camera and have downloaded the latest version of the TD app. You must have a minimum iOS 8.0+ or Android 4.1.x+ version on your device in order to use TD Mobile Deposit.

Expand How do I sign up for TD Mobile Deposit?

- Login to the latest version of the TD app

- Locate Deposit in the menu

- Follow the steps to register for TD Mobile Deposit

Expand How do I deposit a cheque?

Once you have registered for TD Mobile Deposit, follow the instructions on screen, which

include:

- Select the account into which you’d like to deposit the funds. Cheques must be drawn on a Canadian financial institution. Cheques payable in Canadian currency must be deposited to an eligible Canadian dollar account and cheques payable in U.S. currency must be deposited to an eligible U.S. dollar account.

- Enter the amount of the cheque.

- Sign and write "For deposit only" and the Account number on the back of the cheque.

- Take a photo of the front and back of the cheque with your smartphone or tablet.

- You also have the option to add a short description in the Personal Memo field.

Expand What should I do with my cheque after I’ve completed my deposit?

After you deposit the cheque, write the date and "Deposited" on the front and keep it in a safe place for 14 days and then destroy it.

Expand When will my money be available in my account?

Access to your funds is the same as if you had completed the cheque deposit at an ATM. Before you complete the cheque deposit using TD Mobile Deposit, you will see the amount of funds that will be available immediately for use. Refer to the Available Now amount shown on the Verify Deposit screen.

Cheques deposited on a business day up until 11:59 p.m. (EST) will be posted to your account the same day. Cheques deposited after 11:59 p.m. (EST) or on weekends or statutory or bank holidays will be posted to your account the next business day. In each case, availability of funds is subject to the Hold Funds Policy.

Expand Is there a limit to the amount I can deposit using TD Mobile Deposit?

Yes, there are limits on the amount of funds you can deposit on a daily and rolling 30-day basis. You can locate your limit in TD Mobile Deposit under the Amount field.

Expand Is there a fee to deposit a cheque using TD Mobile Deposit?

There is no fee to deposit a cheque using TD Mobile Deposit to a Personal Bank Account or to a Business Chequing Account that has the TD Unlimited Business Plan.

A fee may be charged where the deposit is made to a Business Chequing Account with the TD Every Day Business Plan or TD Basic Business Plan according to the terms of the plan. Fees are charged to deposit a cheque to a Business Savings Account using TD Mobile Deposit.

If there are changes to fees in the future, we will notify you 60 days in advance.

View full TD Mobile Deposit Terms and Conditions for more information.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

TM Google Play are trade-marks of Google Inc.