Guaranteed Investment Certificates (GICs) and Term Deposits are a safe way to save money because your initial investment (principal) is protected. And depending on the type of GIC you choose, you may earn a guaranteed rate of return for the term of your investment.

What are the benefits of TD GICs and Term Deposits?

Safety and security

Your original investment and interest payments are guaranteed.

Flexible terms

Terms range from 30 days to five years.

Eligible for non-registered and registered investment plans

GICs are available in non-registered and registered accounts (RSP, RESP, RIF and TFSA). Term Deposits are available in non-registered and registered accounts (TFSA).

Explore your GIC and Term Deposit options today

Visit any TD Canada Trust Branch

Call 1-866-222-3456 to discuss your options

If you have an account with TD Canada Trust you can apply now.

Apply now

The benefits of laddering GIC maturities

Developing a laddered maturities plan can be an easy way to help you maximize GIC returns while maintaining a secure portfolio. This proven method of investing (also known as a laddering strategy) can help you reduce the risk of interest rate fluctuations and increase your portfolio's overall return.

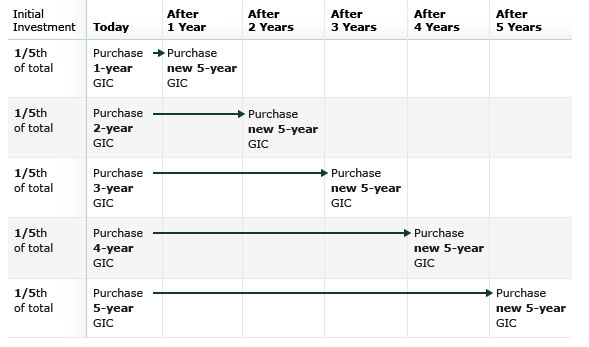

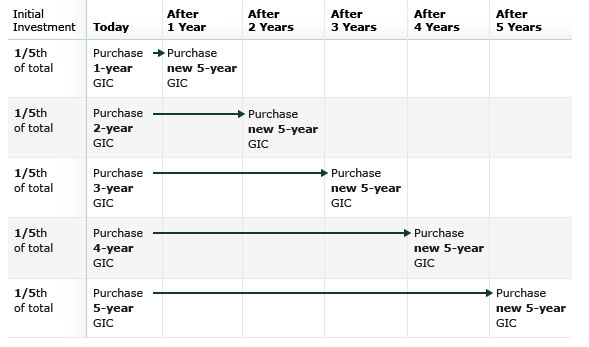

Laddering maturities can be achieved in two steps:

1. Dividing the amount you are planning to invest by 5 (e.g. $10,000.00 equals five investments of $ 2,000.00 each).

2. Equally investing in five GICs of one- to five-year terms (e.g. $2,000 in a one-year GIC, $2,000 in two-year GIC, $2,000 in five-year GIC).

As a result, 20% (1/5th) of your portfolio will mature each year. This can be cashed, or reinvested for five years at the then prevailing rate. This strategy locks in the portfolio for higher long-term rates, yet also provides liquidity.

Strategies for maximizing return while minimizing risk

If your goal is to reduce interest rate risk, you can begin by spreading the maturity dates so that one or more certificates (and approximately 20% of your GIC portfolio) comes up for renewal each year for the next five years.

If you want to increase the rate of return, every time a certificate comes up for renewal, reinvest it as a 5-year GIC. Work toward a portfolio of laddered 5-year GICs with some renewing each year, so that you receive the higher long-term rates.

Explore your GIC and Term Deposit options today

Visit any TD Canada Trust Branch

Call 1-866-222-3456 to discuss your options

If you have an account with TD Canada Trust you can apply now.

Apply now

Have a few questions?

We've provided answers to some of the most common questions people have about GICs and Term Deposits.

Yes, cashable GICs and Term Deposits may be cashed-in early, in full or in part, subject to certain terms and conditions.

Earnings in GICs and Term Deposits held in a registered plan, such as RSPs are tax-deferred and tax-free when held in a TFSA. Earnings received on non-registered GICs and Term Deposits will be taxed as interest income in the year in which it is earned. A T5 is issued after maturity.

Term Deposits and GICs both offer secured investments with guaranteed returns. The main difference is in the duration of the investment. Term Deposits tend to have a shorter investment period of one year or less, while GICs can be locked-in for longer periods of time, up to 5 years.

Yes, GICs can be purchased within both non-registered or registered accounts, such as RSPs and TFSAs.