Choose a savings plan to explore:

Saving for a vacation

When you’re

working hard, a well-deserved vacation can refresh

When you’re

working hard, a well-deserved vacation can refresh

and energize you. Just planning a vacation is proven to

boost your overall happiness.1

Before you start putting money away for your next trip, it’s

wise

to explore your options and see just what type

of vacation suits

you best. Is it a week at an

all-inclusive resort, a month-long

self-guided trip

through Europe, or a cruise through the

Mediterranean?

Canadians taking time off during the winter will generally

spend about $2,600.2

Here are our suggestions to help save for a vacation

Start Saving Today

To start saving for your vacation, we suggest a

TD Every Day

Savings Account

with a

Pre-authorized

Transfer

Service

(PTS). A PTS can easily be set up so that you are

automatically transferring the money

for your

vacation from your chequing account to your savings account

on a regular basis.

Another great way to put money aside for a vacation is the

Simply Save

program. With Simply Save,

every transaction you

make with your TD Access Card you are also making a

contribution to your

savings. You can choose to

contribute $0.05 - $5 from your chequing to your TD Every

Day Savings

Account each time you make a purchase,

and watch those smaller contributions add up to a great

vacation.

Saving Tips

- Every time you get a deal, like a 2-for-1 or use

a coupon, put that money you would have

spent right into your savings. - Use cash. Put your weekly entertainment budget in

cash so you can easily see how much

your spending and how much you have left. If it’s getting low, you might decide to skip that

afternoon treat.

In addition to your budgeted savings, there are lots of

small things you can do that could really

add up and

help you reach your goal sooner. Take a look at some easy

savings tips:

Here's a summary of the products, tools and

services

that may help you with your savings goals

Starting your savings

Visit a branch today to speak with an

advisor and build

your customized savings plan

1Source: http://well.blogs.nytimes.com/2010/02/18/how-vacations-affect-your-happiness/?_php=true&_type=blogs&_r=0

2Source: http://www.newswire.ca/en/story/1125215/cibc-poll-canadians-spending-an-average-of-about-2600-on-their-march-vacations-this-year

Saving for a wedding

Congratulations!

Getting engaged and planning a wedding are

Congratulations!

Getting engaged and planning a wedding are

joyful times in

one’s life. A wedding is a wonderful opportunity to

celebrate an exciting step in your life, and host an event

with

family and friends that you won’t ever forget.

You may have been dreaming of this day for years, or are

just

beginning to plan. Either way, it’s easy for

wedding costs to really

add up.The average expected

cost of a wedding in Canada

excluding the honeymoon

is $22,429.1 So, it’s important to sit

down with your future spouse or family and talk about what

is

really important for you both to have at your

wedding and what’s

flexible. Once you know these

details, you can begin saving for

your special day.

Here are our suggestions to help you save for a wedding

Start Saving Today

Opening a TD High Interest Savings Account(HISA) will give you a place to put away the money you’re saving for your wedding, along with any monetary help you’ve received from family or friends.

Once you’ve got your savings account open, setting up a

monthly Pre-authorized

Transfer

Service

is an easy way to make sure the money you’ve allocated

for the wedding gets from

your chequing account to your

HISA on a regular basis.

40% of couples

are engaged for 13-18 months before tying the knot,which is

a nice amount of time to

40% of couples

are engaged for 13-18 months before tying the knot,which is

a nice amount of time to

build your wedding savings.2

Saving Tips

- Set up a short-term savings goal. Saving just $20 a week can add up to over $1,000 a year.

- Save all your change. At the end of each day,

take all the change from your wallet and place

it in a ‘wedding fund’ jar. Just $2 a day from each of you can add up to over $1,000 in a year.

Put your savings to work for you

Once you’ve had time to accumulate some savings for your wedding, you can start to invest it and earn more money.

Talk to a Financial Advisor about investing your savings

into a Guaranteed

Investment Certificate

(GICs) or Term

Deposits that have a maturity date that align with your

wedding planning.

-25.jpg)

GICs and Term Deposits provide a safe way to save because

your initial investment is

protected. Many GICs and Term

Deposits have flexible terms that range from 30 days to

five

years, so depending on when you’re having your

wedding, this could be a good option for

growing your

savings.

Here's a summary of the products, tools and

services

that may help you with your savings goals

Starting your savings

Putting your savings to work

Visit a branch today to speak with an

advisor and build

your customized savings plan

1Source: http://business.financialpost.com/2013/01/26/affordable-wedding-planning-tips/

2Source: http://www.huffingtonpost.com/2013/01/04/average-engagement-length_n_2411353.html

Saving for a home or condo down payment

Taking the step

to buy a home of your own is a very exciting and

rewarding experience. A good place to get started is

considering your options: condo or house? The

neighbourhood? Fixer-upper or new construction?

Once you’ve got a feel for the cost implications of

these decisions, then you can roughly determine

what you’re looking at spending.

The national average home price is climbing and currently sits just over $400,000.1

The cost of a home may seem overwhelming, and saving for a down payment can be daunting if you are just starting out. But, with the proper planning, budgeting and saving you can be well on your way to owning your own home.

Here are our suggestions to help you

save

for a down payment

Start Saving Today

Open a TD

High Interest Savings Account or a Tax-Free

Savings Account to start putting the money away

for your down payment. Moving your down payment savings out

of your everyday banking account and

into one of

these accounts will help you set your funds aside and build

your savings.

Make it easier to save by setting up a Pre-authorized

Transfer Service. This service can be set

on a

weekly, bi-weekly or monthly basis and will automatically

move the funds you’ve

budgeted for your down

payment from your everyday bank account into your savings

account.

Consider using your Retirement

Savings Plan (RSP) to help with your down payment. For

first

time home buyers, the Home

Buyer’s Plan lets you withdraw up to $25,000 from your

RSP (up to $50,000 for a couple) to help with your down

payment2.

Saving Tips

In addition to your budgeted savings, there are lots of

small things you can do that could really

add up

and help you reach your goal sooner. Take a look at some

easy savings tips:

- Save your change! If you put your spare change

aside at the end of every day, it can really

add up. That $1.00 of change a day saves you $365.00 a year. - Take your lunch at least twice a week. If you’re

saving $10 each time you bring your lunch,

that could add up to close to $1,000 in savings a year. - Borrow instead of buy. Your neighbourhood library

has tons of books and DVDs to choose

from, so instead of buying a new book or DVD each month – sign them out for free. That

could add up to around $240 of savings a year.3

Put your savings to work for you

Once you’ve had the time to build up some savings for your

down payment, you can start to invest it and

earn

more money.

Talk to a Financial Advisor about investing your savings

into a Guaranteed

Investment Certificate (GICs)

or

Mutual Funds4.

-25.jpg)

GICs

and Term Deposits provide a safe way to save because your

initial investment is

protected. Many GICs and

Term Deposits also guarantee a rate of return for the term

of your

investment, which can help you plan when

and how you’ll use that money.

Investing in mutual

funds means you’re putting your money into a portfolio of

bonds, stocks,

and/or money market investments –

all selected and managed by a professional. Investing in a

number of different assets through a mutual fund, can

lower your risk because your money is

not

dependent on the performance of a single investment.

Setting up a Pre-authorized

Purchase Plan automatically invests your money in TD

Mutual

Funds at regular intervals. It ensures

that you’re paying yourself first.

Here's a summary of the products, tools and

services

that may help you with your savings goals

Creating a budget

Starting your savings

Visit a branch today to speak with an

advisor and build

your customized savings plan

1Source: http://www.cbc.ca/news2/interactives/housing-canada/

2Conditions and eligibility requirements apply.

3Source: http://www.tdgetsaving.com/#/savings-tips

4Mutual Funds Representatives with TD Investment

Services Inc. distribute mutual funds at TD Canada Trust.

Saving for a child's education

A post-secondary education is an important step to ones’ success, and helping a child realize that goal is a great achievement.

But the cost of higher education is rising, and tuition alone can be quite expensive. The average university tuition in Canada is approximately $5,7001 a year and that doesn’t include books or living expenses.

With the right planning, you can make saving a part of your routine and help your education savings grow.

Here are our suggestions to help save

for a

child’s university or college education

Start Saving Today

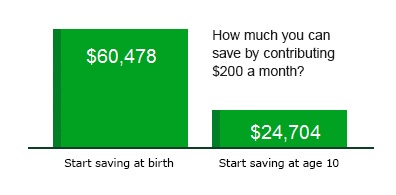

Start by opening a Registered Education Savings Plan(RESP) for a child. An RESP is an account registered with the Government of Canada to help you save for a child’s post-secondary education. When you contribute to an RESP, you become eligible for government grants that can amount to thousands of dollars for a child’s future education.

The government gives you a basic grant of 20% on the first $2,500 of annual contributions to an RESP. That's up to $500 per beneficiary each year to a lifetime limit of $7,200 towards a child's education.

This chart assumes a 2% rate of return (moderate risk portfolio) compounded annually until the child is 18 years old. Savings include your contributions, government contributions, and investment income. Calculations assume basic Canada Education Savings Grant (CESG) contribution of 20% annually. Additional CESG grants may be available depending on your income.

For Illustrative Purposes Only

Build education savings for your child

using the Universal Child Care Benefit

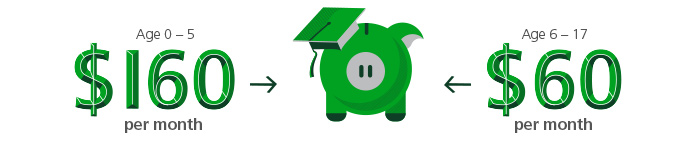

The enhanced UCCB can be a great way to start saving for a child’s education.

The federal government through the Universal Child Care Benefit provides monthly payments to families of $160 per child between 0-5, and $60 per child between 6-17. That’s a total of up to $20,160 per child in lifetime benefits.

With an Education Savings Plan, you're eligible to receive the Canada Education Savings Grant (CESG), which matches 20% of annual contributions up to a maximum of $500 per year and $7,200 lifetime limit, per child. That means you could receive up to $4,0322 in CESG benefits per child when you contribute your full UCCB payments from age 0 to 17 amounting to $20,160 to an RESP.3

So start or increase your education savings by putting your UCCB into a RESP at TD.

Want to know how much you could save for a child in an RESP?

Here's a summary of the products, tools and

services

that may help you with your savings goals

Starting your savings

Visit a branch today to speak with an

advisor and build

your customized savings plan

1 Source: Statistics Canada, Centre for Education Statistics.

2 $4,032 is calculated on the assumption that the RESP is eligible for the Canada Education Savings Grant (CESG). The CESG will top up annual RESP contributions by 20% on the first $2,500 in contributions (up to $500 per child each year, to a lifetime limit of $7,200, per child).

3 $50,000 per child is the lifetime contribution limit.

Saving for retirement

We all look forward to the day

we can retire, kick back and enjoy

We all look forward to the day

we can retire, kick back and enjoy

some much deserved free

time. While that day might seem far

off, the sooner

you start saving the more you’ll have to work with

later on.

According to Statistics Canada, the average Canadian retires

by

the age of 63.1 That means the

average retirement in Canada

now lasts for

approximately 20 years.

So how do you start planning? Start with what your ideal

retirement looks like – how do you want to spend your time?

Do

you imagine your lifestyle will change

drastically, or not all? Once

you have an idea of

how you’d like to spend your retirement, our

Retirement Savings Calculator

can help you start planning for how

much you’ll need to save to do it comfortably.

Here are our suggestions to help you save for retirement

Start Saving Today

It's important to begin saving for the long-term so you can

retire comfortably and live the lifestyle you

want. A Retirement

Savings Plan (RSP) or a Tax-Free

Savings Account(TFSA) are great ways to start

saving for

the future RSPs reduce your taxable income, and growth

earned is non-taxable as long as it

remains in the

RSP, helping you build a larger retirement fund for the

future. A Tax-Free Savings Account (TFSA) is another great

option to help save towards your retirement goal, because

your savings grow

tax-free. You don't pay taxes on

the investment income or growth earned in your TFSA, even

upon

withdrawal, - helping you build your savings

faster.

Consider setting up an Automated

Savings Plan. Automatically transferring funds from your

everyday chequing account into your RSP or TFSA account

provides a disciplined approach to

saving. With this

savings method, you’ll never have to worry or wonder about

missing a

contribution and your savings can grow without

you even thinking about it.

Saving Tips

There are lots of small things that can help your savings add up:

- Take advantage of an employees savings programs

in which your employer matches or

supplements what you’re contributing. - Put any bonuses you receive right into your

savings. Set aside a small amount

to treat yourself, but put the majority of that bonus away.

Put your savings to work for you

TD offers investment options to help you achieve your goals

no matter how big or small. With a wide

range of investment

options for RSPs and TFSAs to choose from, you’re sure to

find the right investment

to help you with your retirement

and savings goals.

-25.jpg)

Guaranteed

Investment Certificates and Term

Deposits are a good investment choice if you

want to give

your money a chance to grow, safe and secure.

Mutual

Funds will give you access to a broad range of

professionally managed investments,

from bonds to stocks

and other investable assets. These investments are

carefully selected and diversified in order to help

minimize risk.

Talk to a Financial Advisor2 about the investment option that is right for you.

Here's a summary of the products, tools and

services

that may help you with your savings goals

Creating a budget

Starting your savings

Visit a branch today to speak with an

advisor and build

your customized savings plan

1Source: http://www5.statcan.gc.ca/cansim/pick-choisir?lang=eng&p2=33&id=2820051

2Mutual Funds Representatives with TD Investment

Services Inc. distribute mutual funds at TD Canada Trust.

Starting your savings

Building savings is not only beneficial for things you may want to do in the future, like buy a home or take a nice vacation, but also provides a layer of security in times of uncertainty.

Half of Canadians are putting less than 5% of their pay cheque towards savings.1

A general guideline is to put at least 10% of your income towards your savings. Even if you’re currently paying off student loans or other debt, it’s essential to ensure you pay yourself too. Then over time as you make more, you can increase the amount you save as well.

Here are our suggestions to help save for the future

Start Saving Today

Open a TD

High Interest Savings Account or a Tax-Free

Savings Account to begin saving towards your

goal. Make it easier to save by setting up an automatic

savings plan called Pre-authorized

Transfer

Service

(PTS). A PTS will automatically move funds from your

everyday bank account into your savings

account.

This is a great way to grow your savings without you even

having to think about it.

Another great way to put money aside is the Simply Save program. With Simply Save, every transaction you make with your TD Access Card you are also making a contribution to your savings. You can choose to contribute $0.05 - $5 from your chequing to your TD Every Day Savings Account.

Saving Tips

There are lots of small things you can do that could

really add up and help you reach your goal

sooner. Take a look at some easy savings tips:

- Write a shopping list and stick to it to help prevent those impulse buys from adding up.

- While you’re at it, buy generic. Many pantry

basics are just as good, if not better, than the

brand name items you pay more for. - Switch one night out a week to a night in.

Instead of meeting friends for dinner, have a get

together at your place.

Put your savings to work for you

Once you've had the time to build up some savings, you can start to invest it and earn more money.

-25.jpg)

Guaranteed Investment Certificates (GICs) and Term Deposits provide a safe way to save because your initial investment is protected. Many GICs and Term Deposits also guarantee a rate of return for the term of your investment, which can help you plan when and how you’ll use that money.

Mutual Funds provide easy access to the growth potential offered by stocks and bonds without you needing to be an expert. Professionals will select and manage the investments held in the mutual fund to seek to maximize growth, as well as help you plan when and how you can use your savings.

Talk to a Financial Advisor2 about investing

your savings into

Guaranteed Investment Certificate (GICs) or Term

Deposits and Mutual

Funds.

Important

Mutual Fund Information

Here's a summary of the products, tools and

services

that may help you with your savings goals

Starting your savings

Putting your savings to work

Visit a branch today to speak with an

advisor and build

your customized savings plan

1Source: http://well.blogs.nytimes.com/2010/02/18/how-vacations-affect-your-happiness/?_php=true&_type=blogs&_r=0

2Mutual Funds Representatives with TD Investment

Services Inc. distribute mutual funds at TD Canada Trust.

Plans & Products

Registered Plans

There's choice when it comes time to invest for your future goals. With our helpful advice, you'll find the plans that are right for you.

Savings & Investment Products

Grow your savings with our innovative investment products. We'll help you understand your options, and provide sound advice.

Ways to Save

Setting up an automatic savings and contribution plan makes saving for your future goals just one of life's routines.

Tools

Retirement Savings Calculator

Find out where you stand

today and how much you'll

need to save to reach your

retirement goals.

TFSA Savings Calculator

Want to know how much you

could save in taxes by putting

money in a Tax-Free Savings Account?

Education Savings Calculator

Find out how much you need

to save today, to meet your

education cost tomorrow.

TD Get Saving

Tools designed to help

you "get" the world of savings.