TD Mutual Funds

Build your portfolio with

professional fund management.

A mutual fund is a portfolio of bonds, stocks, or other investable assets like money market products, that are selected and managed by a professional on behalf of many investors, like you. A mutual fund pools your money with other investors so that you can gain access to more underlying investments than you would normally have access to. With so many different types of mutual funds available, there may be one or more that fits your lifestyle and investment goals.

What are the benefits of a mutual fund?

Professionally managed

A professional will decide the best mix of investments and will manage it all on behalf of the fund’s investors, so you don’t have the work or worry.

Broad range of investments

By investing in a number of different assets through a mutual fund, you’re minimizing your risk because your money is no longer dependent on the performance of a single investment. Learn more about mutual funds and investment strategies

Flexible mutual fund options

A Mutual Funds Representative with TD Investment Services Inc. at TD Canada Trust can work with you to find the type of fund or portfolio of funds that fits you and your goals. And once you get started, you can automatically grow your investment with a Pre-Authorized Purchase Plan.

Explore your mutual fund options today

Visit a branch at a time that's convenient to you.

By phone

1-866-222-3456

TD takes the work out of investing

TD provides a wide range of high-quality mutual funds for every kind of investor. From individual funds to portfolios of mutual funds – there is a solution to match your unique comfort level and investment goals. And because mutual funds are professionally managed, you can start investing without needing to be a financial expert.

What type of mutual funds are available

TD Mutual Funds›

TD Mutual Funds are an easy way to start investing in a broad range of investment types, without the hassle of managing them.

Learn more about TD MutualFunds›

Highlights

- A Mutual Funds Representative with TD Investment Services Inc. at TD Canada Trust will help you find the mutual funds that are right for you

- Over 60 different industry-leading mutual funds to choose from

- Start investing with as little as $25 in a Pre-Authorized Purchase Plan

TD Comfort Portfolios›

A TD Comfort Portfolio is a collection of high-quality TD Mutual Funds. It’s a convenient all-in-one solution where your portfolio is professionally designed and maintained, so you can feel confident in your investment.

Learn more about TD ComfortPortfolios›

Highlights

- Step-by-step support, from choosing the right portfolio to maintaining your investment

- Experts working for you day in and day out

- Plus, if the initial lump sum purchase minimum is met, you can make automatic contributions with a Pre-Authorized Purchase Plan

TD Retirement Portfolios›

Our TD Retirement Portfolios are carefully constructed investment funds built with retirees in mind. These all-in-one investments provide the potential for security, income, and growth and are intended to help you live your retirement the way you want.

Learn more about TD RetirementPortfolios›

Highlights

- Low volatility stocks can reduce the risk of your investment

- Experts balance these funds in reaction to market changes regularly

TD e-Series Funds›

If you like to invest online – TD e-Series Funds are a great way to start investing. Because you buy online and receive all your statements online – the savings get passed on to you.

Highlights

- MERs as low as 0.33%*

- Potential for higher returns with lower investment costs

- No additional set-up or commission fees

*As of December 31, 2012

TD Mutual Fund Accounts

TD Mutual Funds offers a full range of mutual fund account options - both non-registered and registered (TFSA, RESP, RSP). So, whether you are saving for a new home, your child's education or your retirement you get professionally managed mutual funds to help grow your savings.

What types of mutual fund accounts are available?

TD Mutual Funds Personal Non-Registered Account›

Start investing without the hassle. With a TD Mutual Funds Personal Non-Registered Account, you can start saving for that special purchase.

Learn more about TD MutualFunds Non-Registered Account›

Highlights

- Start investing with as little as $25 in a Pre-Authorized Purchase Plan

- Convenient 24-hour access through EasyLine and EasyWeb

- Available as a personal or joint account

- No limits on how much you can deposit into your account

TD Mutual Funds RSP Account›

Make the most of your mutual fund investment by including it in your retirement savings plan (RSP).

Learn more about TD MutualFunds RSP Account›

Highlights

- Your mutual fund grows on a tax-deferred basis

- Start investing with as little as $25 in a Pre-Authorized Purchase Plan

- Convenient 24-hour access through EasyLine and EasyWeb

TD Mutual Funds TFSA›

A Tax-Free Savings Account (TFSA) is a great place to purchase investments like mutual funds because you don’t pay any tax on the income you earn on your investment, and you don’t pay income tax on the amounts you withdraw.

Learn more about TD MutualFunds TFSA›

Highlights

- You don’t have to pay taxes on the investment earnings

- You can make withdrawals when you need them and not pay any tax

- Any amounts you withdraw can be put back in the following year

- You can choose a TD Comfort Portfolio for a convenient all-in-one investment solution

TD Mutual Funds RESP›

TD Mutual Funds are a great choice for RESPs because they help you save and plan for your child’s post-secondary education. Because you are spreading out your money across many bonds, stocks or other assets, you are helping to reduce the impact that dips in the market can have on your investment.

Learn more about TD MutualFunds RESP›

Highlights

- Grows tax-free and there are no account fees

- The government makes contributions to the RESP through grant programs

- You can choose a TD Comfort Portfolio for a convenient all-in-one investment solution

- Start with as little as $25, and continue saving without even thinking about it with a Pre-Authorized Purchase Plan

TD Mutual Funds Retirement Income Options›

When it comes time to convert your RSP into a Retirement Income Fund, make your retirement money work hard for you on a tax-deferred basis by investing it in a mutual fund.

Learn more about TD MutualFunds Retirement Income

Options›

Highlights

- Industry-leading mutual funds

- Lump sum withdrawals and transfers between funds can be made at any time for no charge

- 24-hour support with a Mutual Funds Representative through EasyLine

- Three different retirement income options are available depending on your situation and source of retirement savings:

- TD Mutual Funds Retirement Income Fund (RIF):

Enjoy all the benefits of a mutual fund plus total flexibility of anytime withdrawals at no charge.

- TD Mutual Funds Life Income Fund (LIF):

Strengthen your portfolio with a mutual fund and get complete control over how you receive your retirement income.

- TD Mutual Funds Locked-In Retirement Income Fund (LRIF):

Grow your retirement savings without having to convert it to a life annuity at age 80.

- TD Mutual Funds Retirement Income Fund (RIF):

Explore your mutual fund options today

Visit a branch at a time that's convenient to you.

By phone

1-866-222-3456

Mutual funds 101

Whether you’re just considering investing or have already established a diversified portfolio, here’s some information about mutual funds you may find helpful.

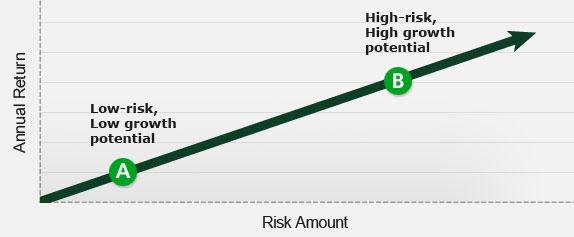

Collapse What is your investment risk tolerance?

One of the basic principals of investing is that the more money you want to make, the more risk you need to be willing to take. This is called the “risk/return trade-off”. What it means is that a mutual fund with a lot of growth potential is subject to the fluctuations in the market. So, someone with a high risk tolerance could stand to make or lose a lot of money, depending on the performance of their mutual fund investments.

The best way to understand the risk/return trade-off is to speak with a Mutual Funds Representative. They guide you through the Customer Investor Profile questionnaire that will help define your investing objectives and your tolerance to risk. Once they understand what you want from your mutual fund investments, they will be able to recommend a mutual fund or mutual fund portfolio that is suitable for your needs.

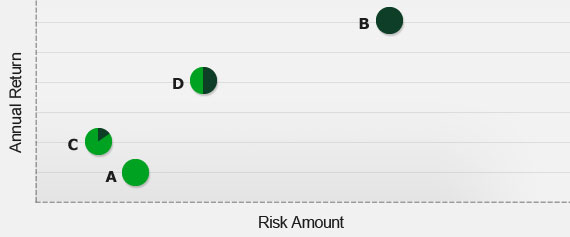

Expand What makes a portfolio low risk or high risk?

The amount of risk associated with an investment portfolio is determined by the types of assets held. Risk can also be associated with the growth potential of a portfolio.

For example in the graph above:

-

Portfolio A is composed entirely of bonds, which over time experienced both a low annual return – or growth – and low risk.

- This is because bonds represent funds borrowed by a company or government in exchange for a predetermined interest rate, and guaranteed return of the principal by the borrower.

- There is very little risk involved, unless that company or government goes bankrupt.

A stock is an individual share in a company. Stocks – also referred to as “equities” - are traded on exchanges all over the world, and therefore are subject to the dips and rises in the stock market.

- Portfolio B is composed exclusively of equities, which over time experienced high risk and high growth.

When a mutual fund portfolio includes a mixture of stocks and bonds, you benefit from diversification across these two asset classes

-

Portfolio C is composed of 80% bonds and 20% equities.

- This portfolio actually experienced lower risk than Portfolio A (100% bonds) and had a higher return.

-

Portfolio D split the portfolio, investing 50% in bonds and 50% in equities.

- While it experienced more risk than Portfolio A or C, it also got a much higher return as a result.

As you can see there are many options in how you can assemble your mutual fund portfolio. A Mutual Funds Representative with TD Investment Services Inc. will work with you to determine your investment goals and risk tolerance, and then recommend the most appropriate mix of assets for you.

Expand Why is a broad range of investments better?

Mutual funds spread your money out across many investment types. This investment strategy is called diversification.

Diversification helps you minimize your risk, because you aren’t putting all your eggs in one basket. You may also benefit from greater return potential.

So, with a mutual fund, your money is no longer dependent on the performance of a single investment, but instead is an average of the entire collection of investments. That way if one stock or bond – or other asset – in a mutual fund portfolio performs poorly, other well-performing holdings within the mutual fund’s portfolio, help offset any losses.

The same can be true when investing in more than one type of mutual fund to complete a well-balanced investment portfolio.

One of the best ways to diversify your portfolio is to invest among the three main asset classes:

- Money market

- Bonds

- Equities

Since asset classes tend to move independently of one another, positive performance in one asset class can help offset negative performance in another.

For mutual fund investors, a diversified portfolio would include a combination of money market funds for safety; bond and mortgage funds for income; and equity mutual funds for potential dividend income and long-term capital growth.

Expand Take advantage of global opportunities.

Another important way to diversify your portfolio is by investing in different countries around the world. Often, certain areas of the global economy are performing better than others. In addition, there are industries that may be better represented in other part of the globe, then they are here at home. By spreading your investments throughout the world, you reduce your overall portfolio risk, while at the same time increasing your long-term growth potential.

Expand A long time horizon can reduce your risk.

Whether you are investing in a bond or equity, they are all subject to fluctuations in market value. Over longer periods of time, however, returns tend to average out and stabilize. Therefore, staying invested longer, helps to reduce your risk and improve your potential for higher returns.

Expand Benefit from dollar-cost averaging.

If you can contribute to your mutual fund on a regular basis, not only are you steadily growing your investment, you are saving money while doing so. If you set up a Pre-Authorized Purchase Plan you are investing a fixed amount to your fund at regular intervals.

This strategy, called dollar-cost averaging, lets you buy more units when prices are low and fewer units when prices are high. While it doesn’t guarantee a profit, or help protect you against a loss, it can result in a lower average unit cost over time.

For example, let’s say you have $60 a month to invest in a particular fund that fluctuates in price.

January price = $5.00 – You buy 12 units

February price = $3.00 – You buy 20 units

March price = $6.00 – You buy 10 units

In three months, you have invested $180 and purchased 42 units, with an average cost per unit of only $4.29.

Best of all, when you set up a TD Comfort Portfolio, a Portfolio Manager does all the work for you. So all you have to do is set up a Pre-Authorized Purchase Plan and enjoy the savings.

In order to set up a Pre-Authorized Purchase Plan, you must meet a $2,000 initial purchase minimum.

Explore your mutual fund options today

Visit a branch at a time that's convenient to you.

By phone

1-866-222-3456

The value of professional investment management

When you’re ready to move beyond savings accounts and Guaranteed Investment Certificates (GICs), mutual funds can offer an easy way to tap into potentially greater returns and help you reach your longer-term savings goals, such as retirement. TD offers solutions for every investor type, whether you’re seeking security, income, growth or a balance of all three. And it takes only $100 to get started.

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.

What does it cost to invest?

Mutual fund costs are typically expressed as a Management Expense Ratio, or MER. The fund costs that make up the MER are not charged to investors directly. Rather, the MER is reflected in the net return of a fund.

MERs vary, depending on the type of fund and how actively managed it is. For example, index funds generally have very low MERs. That’s because they are passively managed — the fund manager simply matches a market index.

With actively managed funds, however, the fund manager buys and sells securities, seeking to outperform the index. Backed by a team of researchers and analysts, fund managers stay on top of market opportunities, looking for ways to maximize returns while mitigating risk and making investment decisions on behalf of all fund investors.

The value behind the MER

Most of the fees you pay are used to cover the cost of managing the fund. When you choose TD Mutual Funds, expertise is built right into every fund. You get:

- Professional fund management. TD Mutual Funds are managed by TD Asset Management Inc., (TDAM), one of Canada’s largest fund managers.

- A wide range of investment options. TD has a broad selection of funds to help meet the needs of all types of investors.

- Stability. With a single investment decision, you can have instant diversification across sectors, investment types and geographic markets, which helps reduce risk.

Management Fee

The management fee has two parts:

- Portfolio management fees, paid to the investment management firm.

- Trailing commissions, paid to the mutual fund dealer servicing your account.

You can benefit from:

Research, investment selection and professional management

You can benefit from:

Ongoing customer care, including advice and service. For more on trailing commissions, see below.

Operating Costs

- Cover accounting, audit costs and record keeping.

Taxes — GST and QST or HST

What are trailing commissions and how do they work?

Trailing commissions are paid by the investment management firm (for TD Mutual Funds, this is TD Asset Management Inc.) to the mutual fund dealer that you bought from (TD Investment Services Inc.). These commissions cover the cost of servicing your account and the advice provided by Mutual Funds Representatives in TD Canada Trust branches and at the call centre.

You can benefit from:

- Dealing with a licensed Mutual Funds Representative, who can explain your options and help you select the fund or funds that

meet your current needs. - Confidence that your trades are being reviewed by a manager.

- The convenience of purchasing when and how you want.

- Help, when you need it, in-branch, over the phone or online.

Are there any sales charges or trading fees?

In addition to management fees, some — but not all — mutual funds charge sales commissions, or “loads.” Funds that don’t have these charges are called “no-load” funds.

Mutual funds that do charge them fall into two categories. You may need to pay a front-end load (charged when you purchase the fund) or a back-end load (charged when you redeem, or sell back, the fund to the company you bought it from).

When you purchase TD Mutual Funds through a Mutual Funds Representative at

TD Canada Trust, there are no loads — 100% of your investment goes to work

for you right away. However, because mutual funds are typically used for

long-term investing, you may be charged a short-term trading fee if you switch or

redeem a fund within 7 days of purchasing it (30 days for index funds).

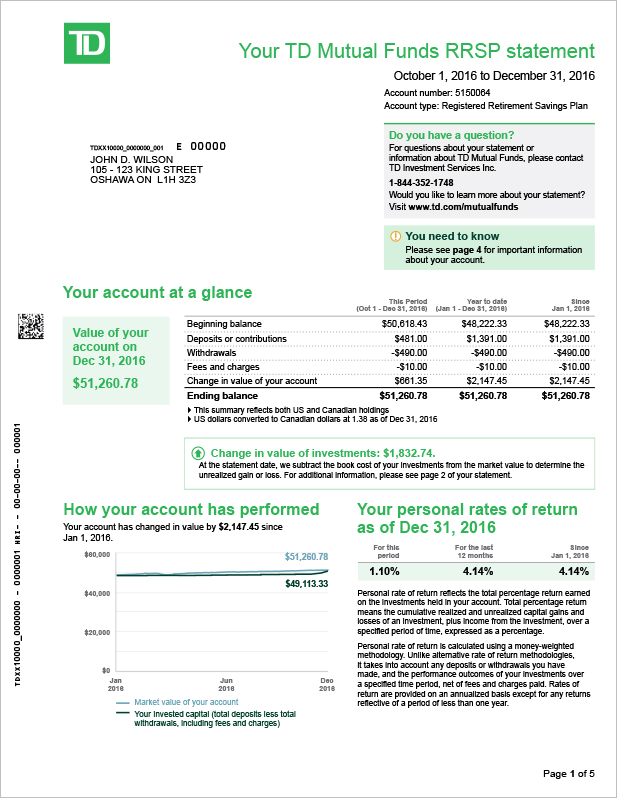

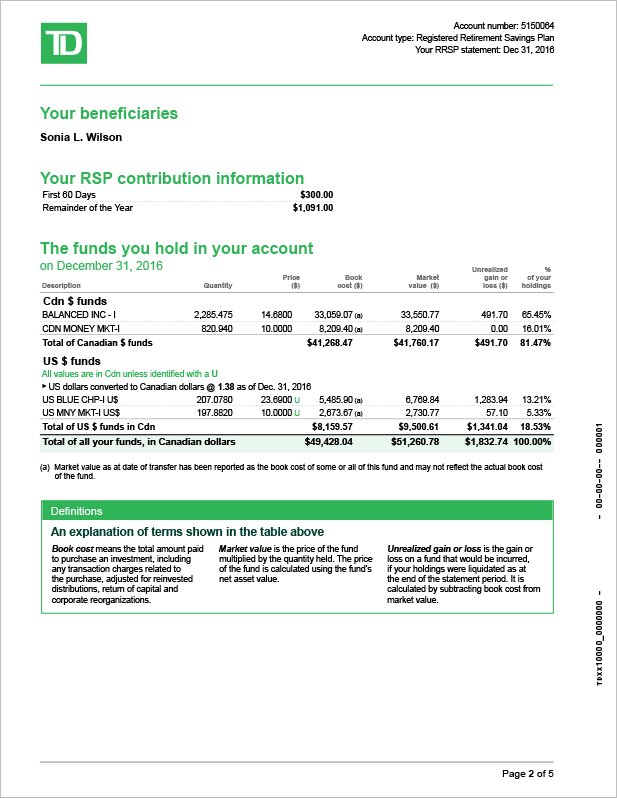

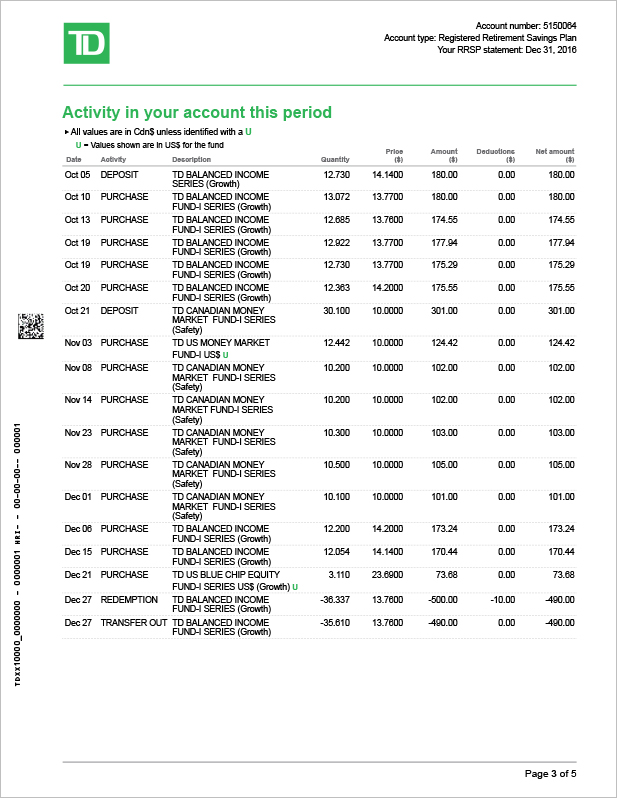

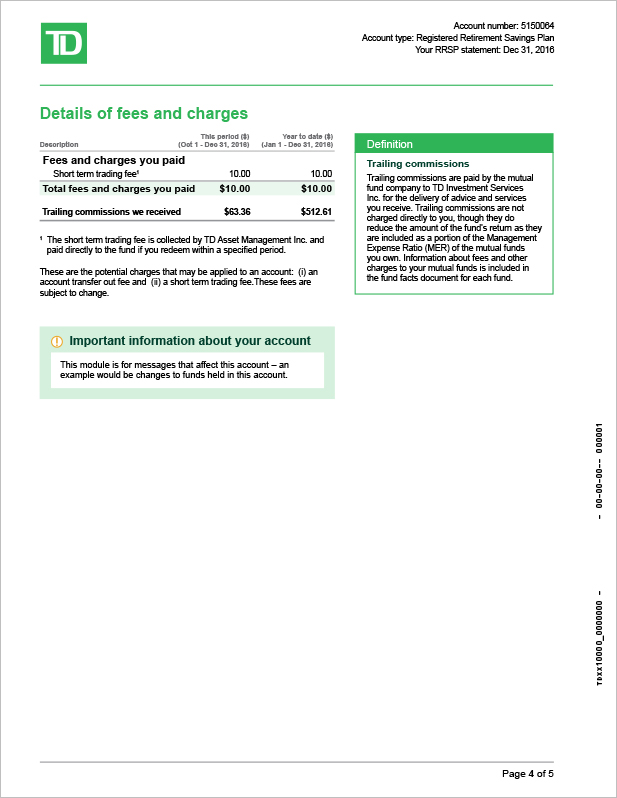

It's now easier to understand the new information on your statement and how your investments are doing. Simply click on the numbered sections to learn more about each section of your statement.

This statement is for illustrative purposes only.

This statement is for illustrative purposes only.

This statement is for illustrative purposes only.

This statement is for illustrative purposes only.

This statement is for illustrative purposes only.

![]()

Have questions about your statement?

Call EasyLine at 1-844-352-1748. We’ll be happy to help!

Have a few questions?

We’ve provided answers to some of the most common questions people have about mutual funds.

Collapse How do I begin investing in mutual funds?

The Six Steps to Building a Financial Plan is an effective way to get started on the road toward financial peace of mind.

Once you have a better idea of where you are now and where you want to be in the future, we recommend that you work with a TD Mutual Funds Representative to help ensure that the investments you choose provide the potential for growth, while at the same time keep your investment risk at a comfortable level.

The TD Mutual Funds Customer Investor Profile questionnaire helps you determine an asset mix that's right for you. With the help of a Mutual Funds Representative, you can then invest in a TD Comfort Portfolio.

You'll benefit from a diversified portfolio that reflects your personal investment needs and objectives.

Once you've created a personalized investment portfolio, you can conveniently access your account – as well as make account transactions – anywhere, anytime.

EasyWeb Internet Access is available 24 hours a day, seven days a week – free of charge. The cut-off time for online Mutual Funds transactions is 3 p.m. ET. Any transaction after this time will be processed as of the next valuation day.

EasyLine, a fully automated touchtone telephone service provided by TD Canada Trust, lets your access your investment accounts 24 hours a day, seven days a week simply by calling the EasyLine toll-free number at 1-866-222-3456.

Or simply visit any TD Canada Trust branch, where a Mutual Funds Representative with TD Investment Services Inc. can help you with all of your investment needs.

Expand Are mutual funds guaranteed?

Since mutual funds qualify as securities and not deposits, they are not guaranteed, their values change frequently and past performance may not be repeated.

However, fund managers and the funds themselves operate under strict securities regulations. For example, mutual funds are owned by the unitholders (people who own the mutual fund) and are separate legal entities from the companies that operate them. Securities legislation also requires that mutual fund assets be held in trust by a custodian on behalf of unitholders.

Expand What types of funds are available?

You can choose funds that invest in money market investments such as government issued treasury bills, income investments such as bonds, or equity investments such as stocks of corporations, both domestic and international.

Some funds are broadly diversified, while others target an asset class or a specific sector of the economy, such as international bonds or science and technology stocks. Others aim to replicate the performance of a well-known index, such as the S&P/TSX Composite Index in Canada or Standard & Poor's (S&P) 500 in the United States.

While there are hundreds of choices, each mutual fund will fall into one of the three main asset classes: safety, income or growth. Or, you can choose a balanced fund which is actively managed to maintain a mix of various asset classes.

Expand How much do I need to start?

The minimum initial investment for TD Mutual Funds is $100 for a non-registered account and $100 for an RSP account. The minimum subsequent investment is $100 for both types of accounts.

A TD Mutual Funds Pre-Authorized Purchase Plan is a convenient and affordable way to build your savings. You can start with as little as $25 per fund per transaction and this amount can be automatically deducted from your bank account on a weekly, bi-weekly, semi-monthly, monthly, quarterly, semi-annual, or annual basis.

Transfers between TD Mutual Funds are free, however, a 2% early redemption fee is payable to all funds except money market funds if you transfer or sell units of these funds within 30 days (90 days for TD e-Series) of purchase. This fee is designed to protect unitholders from the costs associated with other investors moving quickly in and out of the Funds.

Frequent trading can hurt a fund's performance by forcing the portfolio manager to keep more cash in the fund than would otherwise be needed or to sell investments at an inappropriate time. It may also increase a fund's transaction costs.

Expand Where can I buy mutual funds?

Mutual funds are sold through registered Mutual Funds Representatives or other registered advisors with mutual fund or securities dealers associated with banks, trust companies and insurance companies in Canada.

At TD, you can purchase TD Mutual Funds through TD Investment Services Inc. by contacting a Mutual Funds Representative through EasyLine telephone services, EasyWeb Internet access or by visiting any any TD Canada Trust branch.You can also purchase TD Mutual Funds through TD Direct Investing and TD Wealth.

Expand What about taxes?

Net income and net realized capital gains earned by a mutual fund are generally passed on to investors in the form of distributions. The frequency of distributions will vary depending on the mutual fund but will generally be monthly, quarterly or annually.

You can also earn a capital gain when you sell your mutual fund or switch from one mutual fund to another at a price higher than you paid.

The tax treatment of distributions received or capital gains realized will depend upon the type of account in which you hold the investment.

If you hold a mutual fund in a registered plan (such as an RSP, RIF, RESP or TFSA) distributions paid by a mutual fund and any capital gains realized are generally sheltered from tax. Any amount you withdraw from a registered plan (excluding a TFSA) is generally fully taxable. Amounts withdrawn from a TFSA are not taxable.

If you hold a mutual fund in a non-registered account, distributions paid by the mutual fund are taxable whether they are received in cash or reinvested into the mutual fund. You will receive a T3 Supplementary/Relevé 16 tax slip which will tell you the amount and type of income to report on your tax return. You must also include in your taxable income any capital gains realized from selling or switching your mutual fund. It's up to you to calculate and report the capital gains you realize on your transactions. Although an official tax slip is not required, mutual fund companies are required to report all sales or switches to Canada Revenue Agency.

Expand What is the difference between book value and average cost per unit?

Book value is the original cost of purchases and reinvested distributions minus the average cost of any redemptions. Average cost per unit is used to calculate any capital gains or losses you may earn when you sell or transfer units of a fund you hold in a non-registered account. The average cost per unit is the book value of your fund divided by the number of units you hold.

Expand What is the difference between global and international funds?

Technically speaking, there's a difference between a global fund and an international fund, from a North American perspective. A global fund may invest in all the markets of the world, including North America, whereas an international fund generally excludes North America.

Expand How do I compare different funds?

While past performance does not guarantee future growth, annualized returns for different periods (e.g. 1-year, 3-years, 5-years, 10 years) are often used to compare funds and the quality of their management. Most major daily newspapers publish mutual funds performance tables each month for periods ranging from one month to 10 years or more.

Comparing a fund with others in its peer group is a good way to evaluate past performance. Mutual fund tables make it easy by grouping similar funds together. The ability to consistently outperform its peers is one sign of a good-quality fund.

To make a fair comparison, it is important to recognize that all funds in one category are not the same. For example, some Canadian equity funds are managed conservatively, while others aggressively pursue growth. One fund manager may emphasize longer-term value, while another may actively trade investment positions at different times in the market cycle. If in doubt, find out from the fund company, the simplified prospectus or the fund facts sheet, what the fund's investment objectives are and how the fund is managed. While some performance numbers can be very attractive, you may discover that the fund's investments are too risky for you.

Expand How does TDAM discourage market timing?

While market timing is not illegal, our funds are designed for long-term mutual fund investors. TDAM started to charge an early redemption fee (ERF) for most TD Mutual Funds many years ago. This 2% fee is applied to investors that buy and sell units of the same fund within 30 or 90 days, thus discouraging for market timing. The amount charged by this process is paid to the fund to cover any costs or possible negative impact to the fund or its unitholders. In addition, we also retain the right to reject purchase orders from a unitholder who is conducting any activity considered detrimental to the funds or its unitholders.

At TD Mutual Funds we are committed to protecting the best interests of our unitholders. We strive to apply the highest standard of care and diligence, and we review our current policies and practices regularly to ensure they continue to protect you and the funds.