Interac e-Transfer®

Interac e-Transfer®

Paying rent or reimbursing a friend? Use Interac e-Transfer

to send money anytime, anywhere in Canada.

Quick & convenient

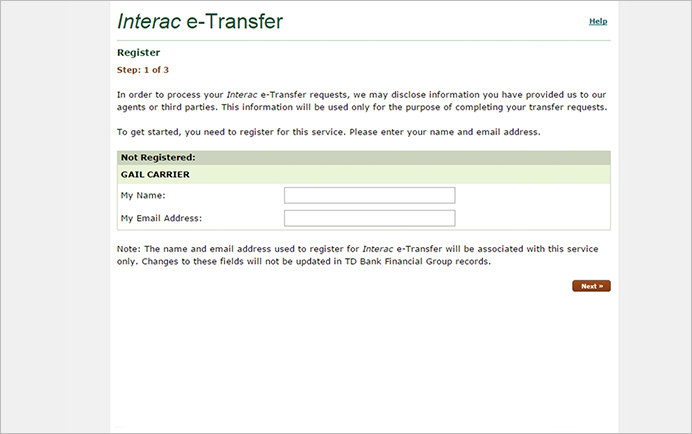

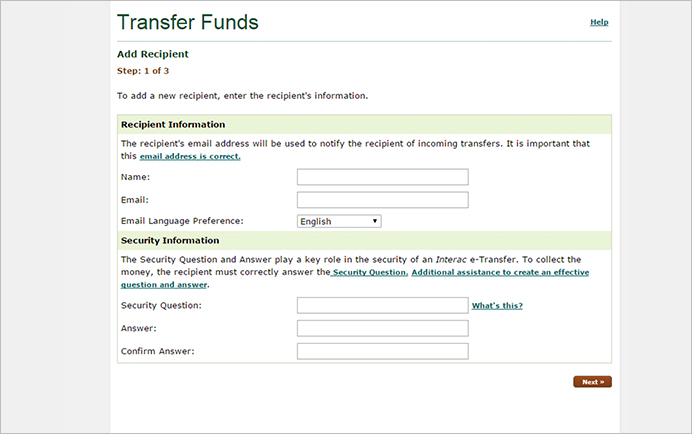

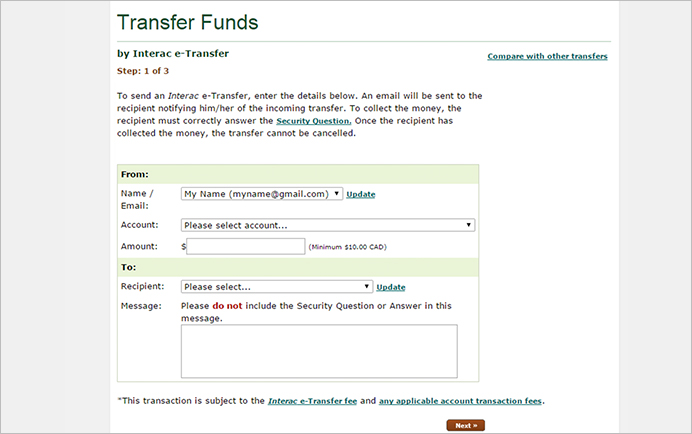

You can send an Interac e-Transfer 24/7 through EasyWeb or the TD app1. You will need the email address of the recipient and to make sure they have a bank account at a participating Canadian financial institution.2

Made for life on the go

Away from your computer? You can also send money using the TD app whether you’re out with friends or at the coffee shop.

Safe & secure

When you send an Interac e-Transfer, the recipient will receive an email notification asking them to log into their online banking and answer the security question you've provided in order to accept the funds.

The transfer fee to send money using Interac e-Transfer from a personal account is $0.503 for each transfer of up to $100, and $1.003 for each transfer of over $100. The fee to send money using Interac e-Transfer from a business account is $1.503. Transfer fee does not apply if you send money using Interac e-Transfer from the following accounts: TD Every Day Chequing Account, TD Unlimited Chequing Account, TD Student Chequing Account, TD All-Inclusive Banking Plan account, and business chequing accounts with a TD Unlimited Business Plan. It's free to receive and deposit an Interac e-Transfer online through a participating Canadian financial institution.4

Legal

1 You must first set up your recipient using EasyWeb or the latest version of the TD app. The TD app is free to download, however standard wireless carrier message and data rates may apply.

2 For a list of participating institutions please visit Interac at: http://www.interac.ca/en/interac-e-transfer-consumer.html#sp-expandable-content-wrapper. Alternatively, the recipient can collect an Interac e-Transfer using the Interac e-Transfer site. Service is only available for Canadian-dollar accounts held in Canada. Check with your landlord first regarding acceptance of rent payments using Interac e-Transfer.

3 Regular account transaction fees may also apply. Transfers can only be made from Canadian dollar bank accounts.

4 If the recipient collects the money through online banking with a participating Canadian financial institution, the transfer will usually take place within 30 minutes. If the recipient chooses to deposit the money using the Interac e-Transfer site, it will take approximately 4-6 business days to complete and a service fee will be deducted by Acxsys Corporation.

5 There are limits on the amounts you can send using Interac e-Transfer:

Per Transfer: $3,000

$3,000 every 24 hours

$10,000 every 7 days

$20,000 every 30 days

Interac e-Transfer is a registered trade-mark of Interac Inc. Used under license.