Market Growth GICs

Earn up to 10.00% with a 3-year TD

Canadian Banking & Utilities GIC*

*Return linked to market index performance. Maximum return of 10.00% is

over the entire 3-year term

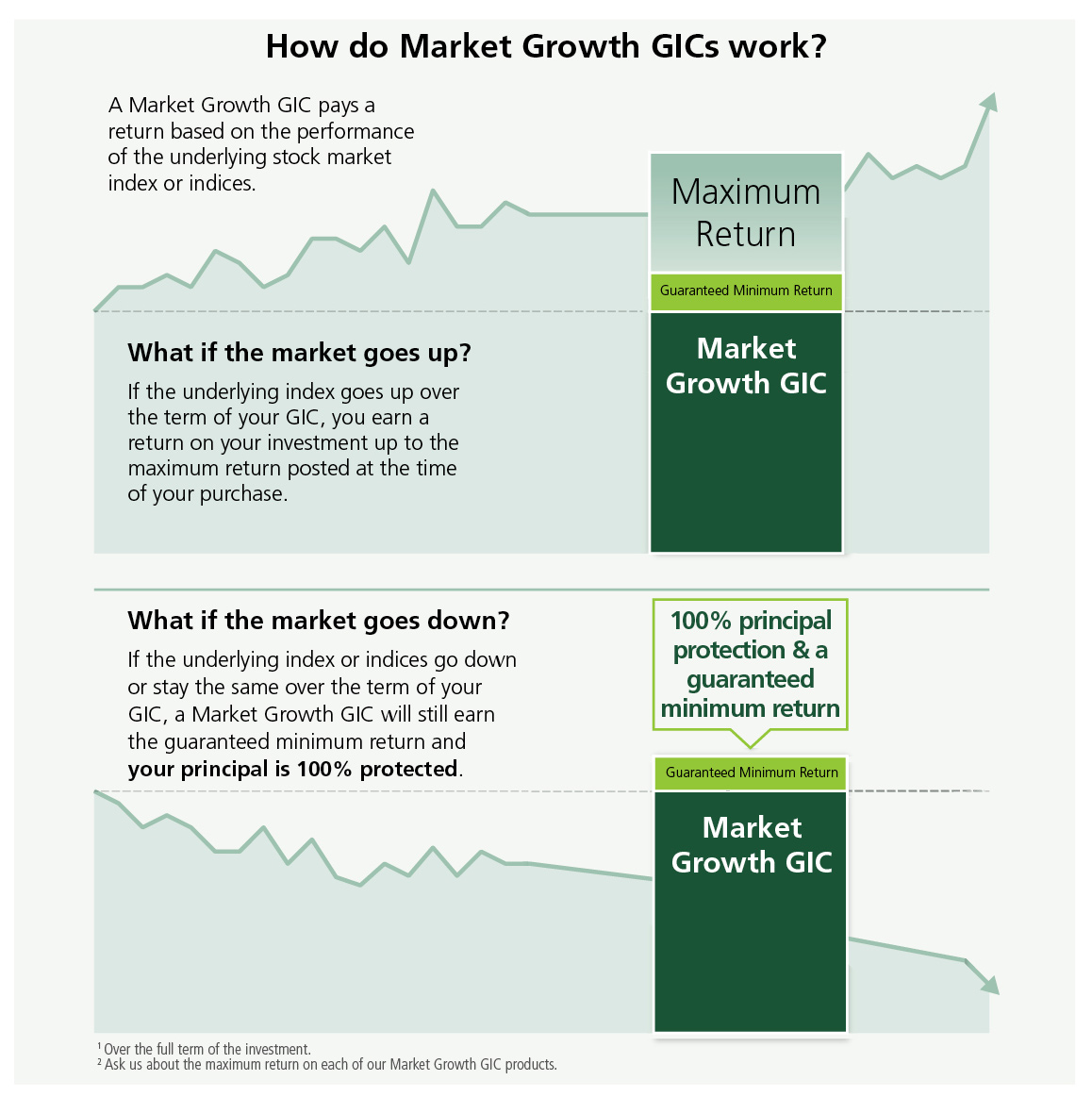

TD Canada Trust Market Growth GICs capitalize on the growth potential of the world's leading stock markets without risking your principal investment. Like traditional GICs, they offer you the peace of mind of 100% principal protection, while taking advantage of the higher return potential of the stock market.

Consider the TD Canadian Banking & Utilities GIC, one of our Market Growth GICs, an investment solution that provides a guaranteed minimum interest return as well as the potential to earn even more.

What are the benefits of TD Market Growth GICs?

100% Guaranteed principal

Get the potential for higher returns with no risk to your principal no matter which way the markets move.

Higher potential return

You could earn up to 20.00%1 on a five-year term.

No fees

You pay no fees whatsoever to invest in a GIC.

Flexibility

You can choose a three- or five-year term. For the TD Canadian Banking & Utilities GIC, you can choose a two-, three- or five-year term.

Low minimum investment amount

Invest as little as $500 for Registered (RSP, RESP, RIF) or $1,000 for Non-Registered and Registered TFSA.

For further details on how the interest return is calculated, please refer to the TD Canada Trust Market Growth GIC Disclosure Statement.

CDIC Eligible

Market Growth GICs are eligible for insurance by the Canada Deposit Insurance Corporation.

Explore your TD Market Growth GIC options today

To visit any TD Canada Trust Branch

Or call 1-866-222-3456 to discuss your options

If you have an account with TD Canada Trust you can apply now!

Apply now1 Applies to TD Canadian Banking & Utilities GIC. Subject to change.

Note: Potential to earn up to a 20.00% return on a 5-year term only applies to TD Canadian Banking & Utilities GIC as of July 26, 2016.

TD helps you find your total investment solution

Market Growth GICs capitalize on the growth potential of the world's leading stock markets without risking your principal investment. Like traditional GICs, they offer you the peace of mind of 100% principal protection, while taking advantage of the higher return potential of the stock market. If you are looking for an investment solution that will provide you a guaranteed minimum interest return as well as the potential to earn even more, then consider the TD Canadian Banking & Utilities GIC, one of our Market Growth GICs.

What types of TD Market Growth GICs are available?

TD Canadian Banking & Utilities GIC

Return Linked to Index:

- S&P/TSX Bank Index (50% weighting)

- S&P/TSX Capped Utilities Index (50% weighting)

These indices are comprised of the stocks of various Canadian financial institutions and Canadian utility companies.

Expand GIC details

| Non-registered and TFSA | RSP, RIF, RESP | |

|---|---|---|

| Investment Minimum | $1,000 | $500 |

| Cashability | Not cashable | Not cashable unless for RESP/RIF payments |

| CDIC Eligible | Yes | |

| Term and Rate | ||

| 2 years | ||

| 3 years | ||

| 5 years | ||

| Interest Payment Options | Guaranteed Minimum Interest is compounded annually and paid at maturity. Bonus interest, if any, is paid at maturity. TD Canadian Banking & Utilities GIC offers a guaranteed minimum interest return. For details of the calculation of the return, see the TD Canada Trust Market Growth GICs Disclosure Statement. | |

1 Actual return is 0.3753% per annum, compounded annually, payable at maturity (equivalent to 0.75% total return)

2 Equivalent to the total return over the term of the investment (i.e. not an annualized rate)

3 Actual return is 0.3333% per annum, compounded annually, payable at maturity (equivalent to 1.00% total return)

4 Actual return is 0.5451% per annum, compounded annually, payable at maturity (equivalent to 2.75% total return)

TD Canadian Top 60 GIC

Return Linked to Index:

- S&P/TSX 60 Index

The index for TD Canadian Top 60 GIC is comprised of the stocks of the 60 largest companies listed on the TSX (as measured by market cap).

Expand GIC details

| Non-registered and TFSA | RSP, RIF, RESP | |

|---|---|---|

| Investment Minimum | $1,000 | $500 |

| Cashability | Not cashable | Not cashable unless for RESP/ RIF payments |

| CDIC Eligible | Yes | |

| Term and Rate | ||

| 3 years | ||

| 5 years | ||

| Interest Payment Options | Guaranteed Minimum Interest Return is compounded annually and paid at maturity. Bonus interest, if any, is paid at maturity. TD Canadian Top 60 GIC offers a guaranteed minimum interest return. For details of the calculation of the return, see the TD Canada Trust Market Growth GICs Disclosure Statement. | |

1 Actual return is 0.5975% per annum, compounded annually, payable at maturity (equivalent to 1.80% total return)

2 Equivalent to the total return over the term of the investment (i.e. not an annualized rate)

3 Actual return is 0.9816% per annum, compounded annually, payable at maturity (equivalent to 5.00% total return)

TD Canadian Banks GIC

Return Linked to Index:

- S&P/TSX Bank Index

This index is comprised of the stocks of various Canadian financial institutions.

Expand GIC details

| Non-registered and TFSA | RSP, RIF, RESP | |

|---|---|---|

| Investment Minimum | $1,000 | $500 |

| Cashability | Not cashable | Not cashable unless for RESP/ RIF payments |

| CDIC Eligible | Yes | |

| Term and Rate | ||

| 3 years | ||

| 5 years | ||

| Interest Payment Options | Guaranteed Minimum Interest Return is compounded annually and paid at maturity. Bonus interest, if any, is paid at maturity. TD Canadian Top 60 GIC offers a guaranteed minimum interest return. For details of the calculation of the return, see the TD Canada Trust Market Growth GICs Disclosure Statement. | |

1 Actual return is 0.4986% per annum, compounded annually, payable at maturity (equivalent to 1.50% total return)

2 Equivalent to the total return over the term of the investment (i.e. not an annualized rate)

3 Actual return is 0.6915% per annum, compounded annually, payable at maturity (equivalent to 3.50% total return)

TD U.S. Top 500 GIC

Return Linked to Index:

- S&P 500 Index

This index is comprised of 500 stocks chosen for market size, liquidity and industry grouping – designed to be a leading indicator of U.S. equities.

Expand GIC details

| Non-registered and TFSA | RSP, RIF, RESP | |

|---|---|---|

| Investment Minimum | $1,000 | $500 |

| Cashability | Not cashable | Not cashable unless for RESP/ RIF payments |

| CDIC Eligible | Yes | |

| Term and Rate | ||

| 3 years | ||

| 5 years | ||

| Interest Payment Options | Guaranteed Minimum Interest Return is compounded annually and paid at maturity. Bonus interest, if any, is paid at maturity. TD U.S. Top 500 GIC offers a guaranteed minimum interest return. For details of the calculation of the return, see the TD Canada Trust Market Growth GICs Disclosure Statement. | |

1 Actual return is 0.3333% per annum, compounded annually, payable at maturity (equivalent to 1.00% total return)

2 Equivalent to the total return over the term of the investment (i.e. not an annualized rate)

3 Actual return is 0.5940% per annum, compounded annually, payable at maturity (equivalent to 3.00% total return)

For further details on how the interest return is calculated, please refer to the TD Canada Trust Market Growth GICs Disclosure Statement

Explore your TD Market Growth GIC options today

To visit any TD Canada Trust Branch

Or call 1-866-222-3456 to discuss your options

If you have an account with TD Canada Trust you can apply now!

Apply nowInvest in your future, not in the fees.

With TD Market Growth GICs, you get the growth potential of the stock market without the fees.

Compare our Portfolios

Expand Compare our Market Growth GICs

TD Canada Trust’s Market Growth GICs

Our lineup of Market Growth GICs provides a variety of options that can align you to the growth potential of stock markets from near and far while keeping your principal safe.

| TD Canadian Banking & Utilities GIC | TD Canadian Banks GIC | TD Canadian Top 60 GIC | TD U.S. Top 500 GIC | |

|---|---|---|---|---|

| Symbol1 | ^TXBA ^TTUT |

^TXBA | ^TX60 | ^SPX |

| Return linked to index / indices | in each of the

|

60 Index |

||

| Minimum Rate Guaranteed | Yes | |||

| Principal Protection | Yes | |||

| Set-up Fees | No | |||

| Term | 2, 3 or 5 Years2 | 3 or 5 Years2 | ||

| Minimum investment | $500 (RSP, RIF, RESP) $1,000 (Non- Registered, TFSA) |

|||

| Foreign Currency Risk | Not exposed to fluctuations in foreign currency since any payable return is paid in Canadian dollars |

|||

1 Index composition and historical performance information of the underlying indices are available by calling 1-866-222-3456.

For online enquiries, please visit www.tmxmoney.com and reference the symbols in the above chart.

2 Not redeemable prior to maturity.

Getting started is easy

We can help you find a TD Market Growth GIC investment that fits your lifestyle. Visit your local TD Canada Trust branch or call 1-866-222-3456

Historical performance

Check out the returns of recently matured TD Market Growth GICs

Expand TD Market Growth GICs Performance chart

How to read the table:

What is a Maturity Period?

A maturity period is defined as a group of three consecutive months (quarter) that comprises all Market Growth GICs that have matured during this period

What does Average return at maturity of a Market Growth GIC mean?

The average return of a Market Growth GIC refers to the simple average of the returns paid in a specific maturity period. For instance, the average return of the 5 Year Utilities GIC Plus for the maturity period of January - March 2012 is calculated as the simple average of the returns paid to all 5 Year Utilities GIC Plus investments that matured between January 1 and March 31 of 2012

What does Average change in the applicable Index mean?

The change in the applicable index/indices is calculated as the difference between the Opening Level (OL) and Closing Level (CL) of the index/indices, expressed as a percentage. Thus, the average change in the applicable index refers to the simple average of the daily changes in the index/indices in a specific maturity period

For instance, the average change in the underlying index of the 5 Year Utilities GIC Plus for the maturity period of January - March 2012 is calculated as the simple average of daily changes in the applicable index on issued 5 Year Utilities GIC Plus investments with an OL set between January 1 and March 31 2007 and a CL set between January 1 and March 31 2012

Scenarios

-

Average return at maturity on a Market Growth GIC is greater than the Average change in its applicable index

During a given maturity period, on average, the return paid on a Market Growth GIC exceeded the change in its underlying index/indices. It is possible that, on any day(s) within the maturity period, the return paid on a Market Growth GIC could be lower or equal to the change in its underlying index/indices

-

Average return at maturity on a Market Growth GIC is lower than the Average change in its applicable index

During a given maturity period, on average, the return paid on a Market Growth GIC was lower than the change in its underlying index/indices. It is possible that, on any day(s) within the maturity period, the return paid on a Market Growth GIC could be greater or equal to the change in its underlying index/indices

-

Average return at maturity on a Market Growth GIC is equal to the Average change in its applicable index

During a given maturity period, on average, the return paid on a Market Growth GIC was equal to the change in its underlying index/indices. It is possible that, on any day(s) within the maturity period, the return paid on a Market Growth GIC could be greater or lower than the change in its underlying index/indices

A note about opening and closing level:

Opening level = closing level of the applicable index or indices two business days after the issue date.

Closing level = closing level of the applicable index or indices two business days prior to the maturity date.

Examples are for illustrative purposes only. Past market performance is not an indicator of future market performance.

1 Security GIC Plus is the only product in our Market Growth GIC lineup that offers a guaranteed minimum interest return.

Explore your TD Market Growth GIC options today

To visit any TD Canada Trust Branch

Or call 1-866-222-3456 to discuss your options

If you have an account with TD Canada Trust you can apply now!

Apply nowHave a few questions?

We've provided answers to some of the most common questions people have about GICs and Term Deposits.

Collapse Are Market Growth GICs right for me?

Market Growth GICs may be a fit for you if you are seeking:

- 100% principal protection

- Potential upside for higher equity - linked market returns

- Do not need immediate access to your money.

Expand Are Market Growth GICs eligible for CDIC insurance?

Yes. For further information on how your deposits are protected, please see the Canada Deposit Insurance Corporation website.

Expand How can I track the market indices?

Changes to the market indices linked to our Market Growth GICs can be easily monitored through a variety of sources such as:

- The financial section of most major newspapers

- EasyLine telephone banking

- Your TD Canada Trust Branch

Expand How are the returns taxed?

Return on a Market Growth GIC is not subject to tax when the GIC is held within registered account, as with conventional registered GICs.

If a Market Growth GIC is held as a non-registered investment, all interest paid to the customer will be taxed as regular interest income in the year in which it is earned. A T5 is issued after maturity.

For the Security GIC Plus, you will receive an annual tax receipt reflecting the interest earned during each calendar year over the term of your investment based on the guaranteed minimum interest return. After maturity you will receive a tax receipt reflecting the total interest return, which will comprise the guaranteed minimum interest return for that year, and any bonus interest return.

Expand Why is the return considered to be interest income and not a capital gain?

You are not actually investing in shares listed on a stock market. The applicable market index or indices is/are used to measure the return on your investment.

Expand How are the Opening Levels calculated?

The Opening Level (OL) is equal to the closing level of the applicable index two business days after issue date. For greater certainty, if the applicable exchange for a non-Canadian index is not open for trading or settlement on the second business day after issue date, the preceding day on which such non-Canadian exchange was open for trading or settlement shall be used for the purpose of determining the OL of that particular index.

Expand How are the Closing Levels calculated?

The Closing Level (CL) is the closing level of the applicable index two business days prior to the maturity date. For greater certainty, if the applicable exchange for a non-Canadian index is not open for trading or settlement on the second business day after issue date, the preceding day on which such non-Canadian exchange was open for trading or settlement shall be used for the purpose of determining the OL of that particular index.

Expand How is the return calculated?

The return for a Market Growth GIC, if any, is calculated as 100% of the return of the underlying index up to the Maximum Return set for each product at the time of purchase. Return of the underlying index = (Closing Level - Opening Level) / Opening Level. For example, the Maximum Return for the 3-year Utilities GIC Plus is set at 12% (subject to change). You will receive the full market return up to 12%. If the return of the underlying index over the three years is 25%, you will receive 12%. The return on the Security GIC Plus comprises both this potential return plus a guaranteed minimum interest return.

Expand What happens if the Closing Level is lower than the Opening Level?

Except for the Security GIC Plus, no interest is paid at maturity.

For the Security GIC Plus, the accrued interest at the guaranteed minimum interest rate will be paid at maturity.

Expand Can Market Growth GICs be sold prior to maturity?

A Market Growth GIC cannot be redeemed or cashed in prior to maturity, except in the case of the death of the holder. In that case, for a Market Growth GIC, only the principal will be repaid. If you purchase a Market Growth GIC, other than Security GIC Plus in your TD Canada Trust Flexi-RIF or TD Canada Trust Education Savings Plan (RESP), payment from your RIF or TD Canada Trust RESP can be made from your Market Growth GIC if that is the only remaining property in your plan. Should a Market Growth GIC be used to fund a payment or withdrawal from your RIF or TD Canada Trust RESP, the portion redeemed will reduce the principal investment and no interest shall be payable on the redeemed amount.

Expand Average return at maturity on a Market Growth GIC is greater than the Average change in its applicable index

During a given maturity period, on average, the return paid on a Market Growth GIC exceeded the change in its underlying index/indices. It is possible that, on any day(s) within the maturity period, the return paid on a Market Growth GIC could be lower or equal to the change in its underlying index/indices

Expand Average return at maturity on a Market Growth GIC is lower than the Average change in its applicable index

During a given maturity period, on average, the return paid on a Market Growth GIC was lower than the change in its underlying index/indices. It is possible that, on any day(s) within the maturity period, the return paid on a Market Growth GIC could be greater or equal to the change in its underlying index/indices

Expand Average return at maturity on a Market Growth GIC is equal to the Average change in its applicable index

During a given maturity period, on average, the return paid on a Market Growth GIC was equal to the change in its underlying index/indices. It is possible that, on any day(s) within the maturity period, the return paid on a Market Growth GIC could be greater or lower than the change in its underlying index/indices