Send money transfers anywhere in the world with EasyWeb

An easy, low cost and secure way to send money online anywhere in the world1

You can send money online directly from your personal TD Canada Trust bank account to a family or friend’s bank account. They will receive your money transfer through their Visa Debit Card, a Visa Credit Card or a Reloadable Visa Prepaid card. With Visa Direct, you can make international money transfers to over 170 countries in more than 150 currencies.

Your money transfer will be available in the card holder’s bank account through a Visa Debit Card.

When you send money to a recipient’s Visa Credit Card, it will appear as a credit balance on the card OR will pay down the balance payable on the credit card.

Money transferred to a Reloadable Visa Prepaid Card will be available as additional funds for use.

Better for you:

- 24/7 Access: You can send a money transfer anytime via EasyWeb.

- Easy: Send money in 3 easy steps; all you need is the recipient’s 16-digit Visa card number, name and address.

- Low Cost Fee: You pay a low fee for the service2.

- Secure: Visa Direct is backed by the TD’s Online Security Guarantee3 and supported by secure Visa network.

- Transparent: You can see exactly how much they will receive in their local currency or the currency of their card3.

Better for them:

- Convenient: They don’t need to go online or travel anywhere to receive your money transfer.

- Safe: No need to pick up large sums of cash.

- Fast: You can send money online to their bank account or card in their local currency, usually within 24-48 hours of the transfer (or as little as 30 minutes for transfers sent to Fast Funds-enabled Visa cards).

Have a U.S. based personal account at TD Bank, America's Most Convenient Bank?

If you are a TD Cross-Border Banking customer, use Visa* Direct to transfer money from your Canadian based personal bank account at TD Canada Trust to your U.S. based personal account at TD Bank, America's Most Convenient Bank and we’ll refund your transfer fees4 the following month. Learn more

International transfers up to $1,000: $8.95 CAD/USD fee2

International transfers from $1,000.01 to $2,500: $12.95 CAD/USD fee2

Get started with 3 easy steps:

-

3. Transfer the money:

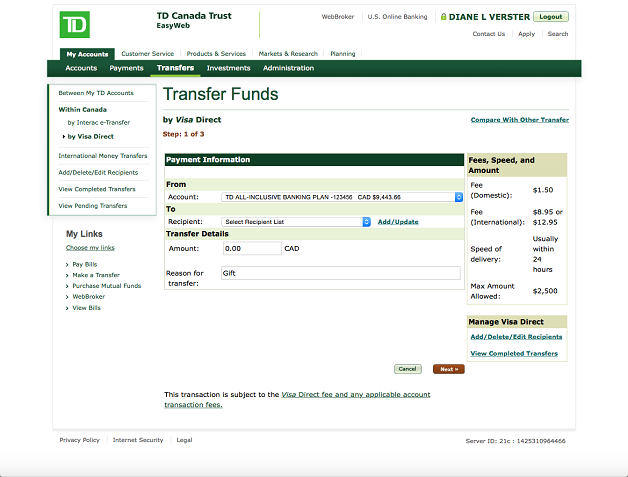

Choose to send money from either your personal TD Canada Trust Canadian or US Dollar Chequing Account or TD Savings Account. Enter the amount you want to send or the amount in the specified currency to be received based on the card number entered. Once you submit the transfer, you can let them know that the money is on its way.

Domestic transfers: $1.50 fee2

Frequently asked questions

Looking for specific information about how Visa Direct works?

See the details here.

Product overview and using EasyWeb:

The Visa Direct service is an easy, low cost and secure way to send money anywhere in the world. You can transfer money securely and easily from your personal TD Canada Trust Canadian or US Dollar Chequing Account or TD Savings Account to any eligible bank account through a Visa Debit card, or to a Visa Credit card or Reloadable Visa Prepaid card.

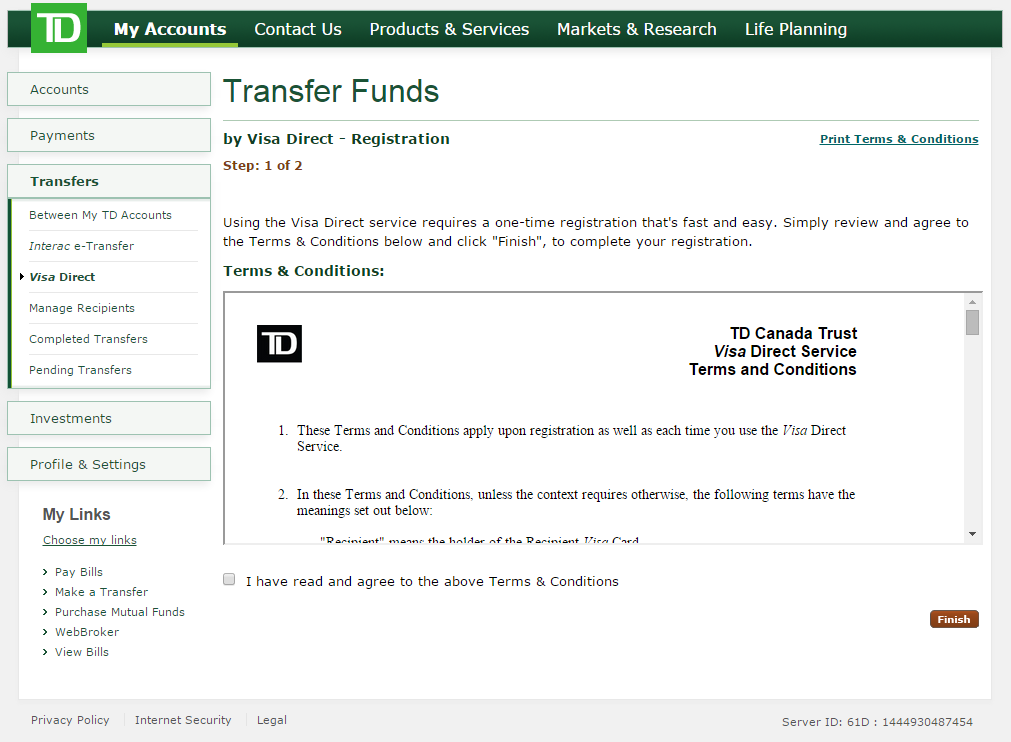

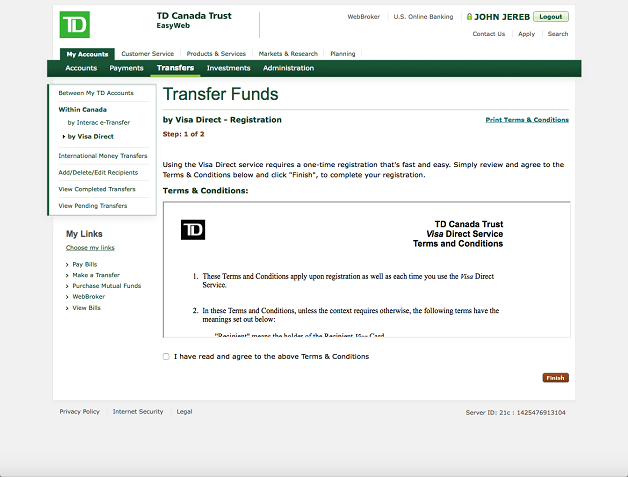

Transferring money has never been easier. Once you have registered for the Visa Direct service, you can begin sending money to a bank account linked to an eligible Visa Debit card, or to a Visa Credit card or Reloadable Visa Prepaid card. It’s simple, here’s how;

- If you haven't already, log in to EasyWeb using your Access Card number or your Connect ID and EasyWeb password.

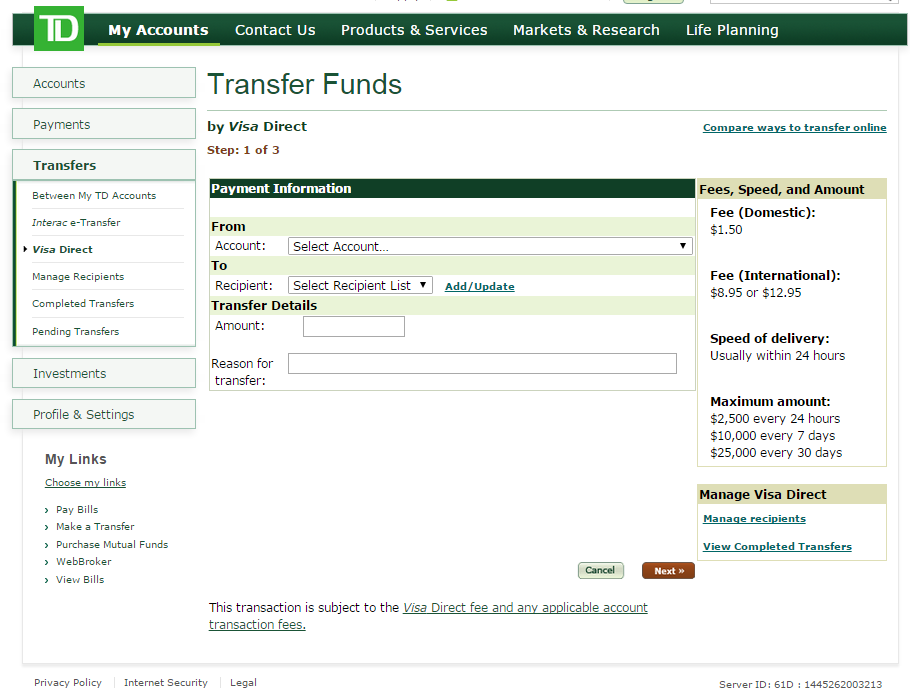

- Select “Payments & Transfers” from the top menu bar then “Transfer Funds” from the left navigation menu. Then select “Transfer within Canada” or “International Money Transfers”.

- Select “by Visa Direct” then choose your personal TD account from which you wish to transfer money and either add a new recipient, or select an existing one.

- Enter the amount to send and select the “Calculate” button to view the total amount that would be received in the foreign currency/currency of the recipient’s card.

- Once you review and confirm the information you have entered, Visa Direct has been sent and a confirmation number will be provided. The transaction amount and the fee will be deducted from your account.

With Visa Direct service you can send money to over 170 countries. However, TD is committed to complying with all applicable laws and regulations in the jurisdictions where TD operates. Therefore, Visa Direct cannot be sent to or from anyone located in a country that is subject to comprehensive economic or trade sanctions. For more information about sanctions, please refer to the Department of Foreign Affairs and International Trade (DFAIT) website.

Note: *At this time, for Visa Direct to the United States, customers can only send money from their personal TD Canada Trust bank account to a debit card issued by TD Bank® America’s Most Convenient Bank. In addition, Visa Direct cannot be sent to Cuba, Iran, North Korea, Sudan, and Syria, as Visa does not currently issue cards in these countries.

Limits for Visa Direct:

Per Transaction Minimum Limit: $10 (CAD/USD)

Per Transaction Maximum Limit: $2,500 (CDN/USD)

24 Hour Rolling Limit: $ 2,500 (CAD/USD)

7 Day Rolling Limit: $ 10,000(CAD)

30 Day Rolling Limit: $ 25,000 (CAD)

There are no limits to the actual number of Visa Direct you can send per day, as long as their total dollar value does not exceed the maximum dollar amount allowed in the applicable time period noted above.

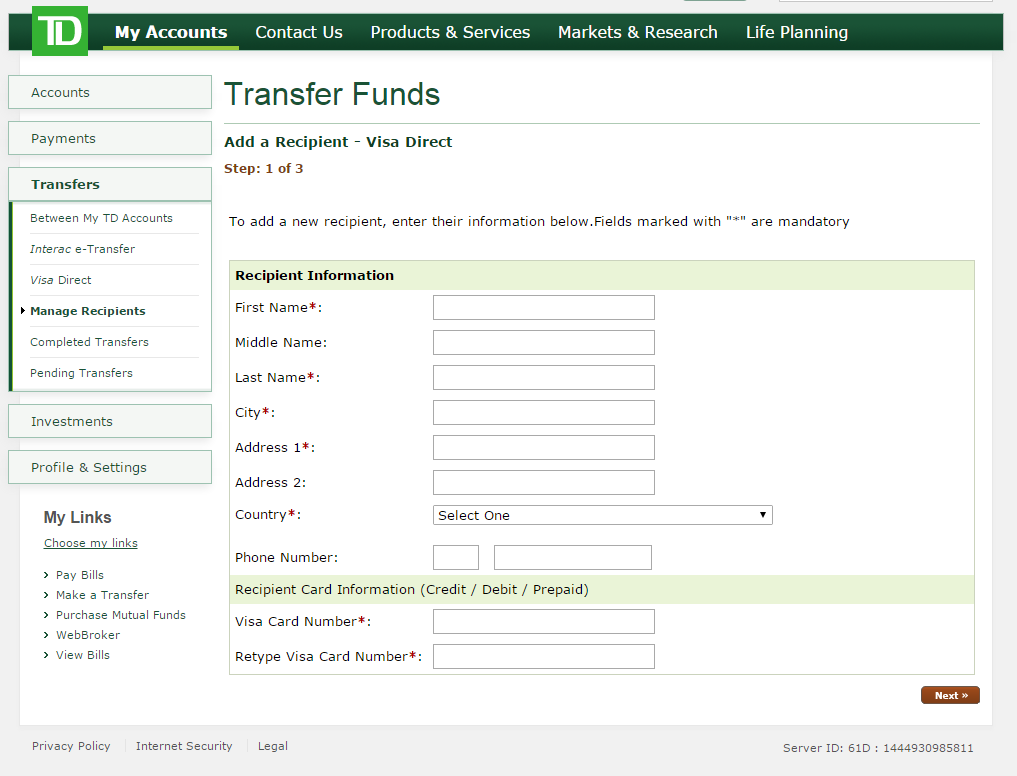

Expand Sending money:

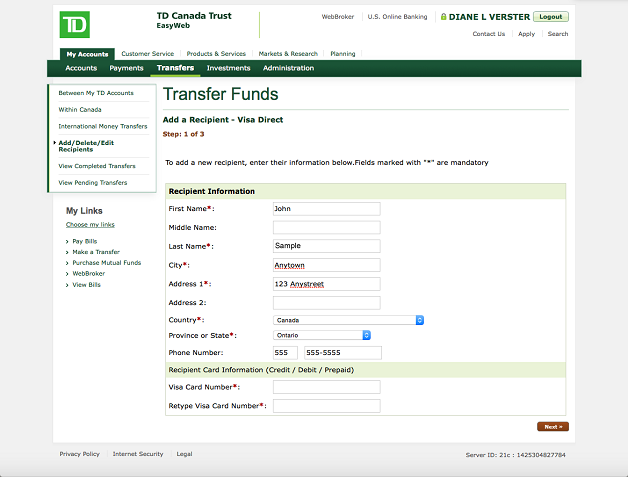

You will need their 16-digit Visa Debit card, Visa Credit card or Reloadable Visa Prepaid card number along with their name and address. You do not need any other card details like the Expiry Date or CVV number (3 digit security code) and should not ask the recipient to disclose that information.

Adding a recipient is an easy one-time process.

- Log in to EasyWeb using your Access Card number or Connect ID and EasyWeb password.

- Select “Payments & Transfers” from the top menu bar, then select “Transfer Funds” from the left navigation menu.

- Select “Add/Delete/Edit Recipients” and then select “Add Recipient”; enter the recipient information and confirm.

Anyone over the age of 18 with a personal TD Canada Trust Canadian or US Dollar Chequing or Savings Account and is registered for online banking can send money using the Visa Direct service in EasyWeb.

You can use your personal TD Canada Trust Canadian or US Dollar Chequing Account or TD Savings Account to send a Visa Direct. Registered Accounts, Youth Accounts, Small Business Banking Accounts, Corporate and Commercial Accounts are not eligible to transfer funds using the Visa Direct service.

For every Visa Direct transaction where a currency conversion is involved, a guaranteed exchange rate will be displayed upon entering the amount to be sent and before you confirm the transaction. The rate of exchange will be applicable for 6 minutes. After 6 minutes you will be prompted to recalculate your request.

No, the Visa Direct service is only available online through EasyWeb and offers you anytime, anywhere convenience.

No, once a Visa Direct transaction is confirmed by you (the sender), it cannot be cancelled or modified.

No, only personal TD Canada Trust Chequing or Savings Accounts are eligible to transfer money.

No, Visa Direct can only be sent to a personal Visa Debit card, Visa Credit card or Reloadable Visa Prepaid card.

In order to take advantage of the Visa Direct service, the recipient’s card must be eligible to receive these transactions. Most Visa Debit card, Visa Credit card or Visa Reloadable Prepaid cards around the world are eligible. However, certain countries and financial institutions may choose not to accept these transactions due to local regulatory or other restrictions. See a list of countries that currently accept these transactions.

Note: *At this time, for Visa Direct to the United States, customers can only send money from their personal TD Canada Trust bank account to a debit card issued by TD Bank® America’s Most Convenient Bank. In addition, Visa Direct cannot be sent to Cuba, Iran, North Korea, Sudan, and Syria, as Visa does not currently issue cards in these countries.

Expand Receiving money:

Funds are transferred into your recipient’s Visa card account in the currency of their Visa card. In most cases, this is the local currency of the country in which the card is issued.

Note - Some recipients may have Visa cards where there is one currency for international transactions and another for domestic transactions. Funds in this case are received in the international currency and then converted by the recipient card issuing bank into the currency of the recipient’s card based on the applicable rate. For example, China has dual currency Visa cards, where there is one international currency for international transactions and Renminbi (RMB) for domestic transactions. Funds in this case are received in the international currency and then converted by the card issuing bank into RMB based on the applicable exchange rate.

| Card Type | Fund Availability |

|---|---|

| Money sent to a Visa Debit Card | All Visa Debit Cards are linked to a bank account. Money transferred to a Visa Debit Card will be available in the card holder’s bank account that the Visa Debit Card is linked to. This is similar to a wire transfer, where money is deposited into the bank account. The recipient can either withdraw the money at an ATM or use their card to make purchases as they would normally use their Visa Debit Card. |

| Money sent to a Visa Credit Card | Money transferred to a recipient’s Visa Credit Card will appear as a credit balance on the card OR will pay down the balance payable on the credit card. Recipients can use their Visa Credit Cards at merchant locations, for online transactions or to withdraw funds from an ATM in the form of a cash advance. Note: Regular cash advance fees or interest charges may apply as applicable on credit cards. |

| Money sent to a Reloadable Visa Prepaid Card | Money transferred to a Reloadable Visa Prepaid Card will be available as additional funds available for use at merchant locations, online or for withdrawals. |

English: 1-866-222-3456

French: 1-800-895-4463

Expand Fees:

Transaction fees and charges will only be incurred by the sender. Visa Direct transaction fees are as follows:

- $8.95 for international transactions up to $1,000

- $12.95 for transactions greater than $1,000.01 up to $2,500

- $1.50 for all domestic transactions

There are no other fees charged to the sender to send money or to the recipient to receive the funds on the card2.

Expand Other questions and troubleshooting:

- Log in to EasyWeb using your Access Card number or Connect ID and EasyWeb password.

- Select “Payments & Transfers” from the top menu bar.

- Select “View Completed Transfers”.

- Select “Visa Direct” from the drop down menu to view a list of completed transactions.

- Select the specific transfer in question and click “View Details”.

You can only transfer funds from a personal TD Canada Trust Canadian or US Dollar Chequing Account or TD Savings Account. Registered Accounts, Youth Accounts, Small Business Banking Accounts, Corporate and Commercial Accounts cannot be used to transfer funds.

All transfers from EasyWeb are backed by TD’s Online Security Guarantee – a name you know and trust and every money transfer is sent through Visa’s secure payment network.

Absolutely. The 16-digit Visa Card number cannot be used for anything other than sending money to it. To perform any purchase transaction with the card, the 3 digit CVV number and the Expiry Date would be needed. You should not ask for the CVV number on the recipient’s card or the Expiry Date.

No, currently the TD Mobile App does not support Visa Direct transactions.

Upon entering the amount to be sent, the screen will display the exact amount that will be received by the recipient in the currency of their card. (In the case of countries like China, where dual currency cards are issued, the funds are sent in the foreign currency and hence the actual RMB amount is determined by the recipient’s card-issuing bank.)

No, TD will not send out a notification about funds being received by the recipient.

TD Helps

You ask, we answer.

Join the conversation and have a TD Expert answer your Visa Direct questions. Ask an expert

1 Certain restrictions apply in the U.S. and other regions. See registration terms and conditions or FAQs for further details.

2 For transactions in currencies other than that of the originating account, a foreign exchange conversion will occur. Customers will be advised of the rate used for the conversion prior to completing the transaction and informed that the exchange rate being used may result in revenue being earned on the conversion by the bank. Transfer fee is in the currency of the account from which the funds are sent.

Recipient's financial institution may charge a fee to process the transfer and this fee may be deducted from the transfer amount. Recipient should check with their own financial institution for more information.

3 Some recipients may have Visa cards where there is one currency for international transactions and another for domestic transactions. Funds in this case are received in the international currency and then converted by the card issuing bank into the currency of the recipient’s card based on the applicable exchange rate.

4 Transfer fee will be debited to your account and then refunded by way of a credit to the same account in the same currency. Refund will be processed within 5 business days of the date on which the eligible transaction occurred if the account has not been closed. You will not receive any other notice of the credit. We may amend or cancel this arrangement at any time. Foreign exchange conversion rates and regular account transaction fees may apply. No other applicable fees or costs will be refunded. Transfer limit is per 24-hour period and is in the currency of the account from which the funds are sent. See Frequently asked questions for information on additional limits.