##NOPAGETITLE##

Small Business Banking

Small businesses need big dreams,

and we want to help make yours a reality

Whether you’re starting your business or have been running it for years, TD has

the products and services to help you get there. From Advisors who will support you through the

highs and lows of business to choosing the right account, we want to be a part of your success.

1. We’ve got an account plan that can help fit your needs.

We’ve got different account plans to help support a wide range of your business needs. Choose from our comprehensive product suite, including:

- $5 Basic Account – our TD Basic Business Plan is ideal for businesses with minimal monthly activity. Get a full-service Business Banking account and only pay for the transactions you process.

- Every Day Account – our TD Every Day Business Plan is a cost-effective banking plan for businesses that have regular monthly transaction patterns.

- Unlimited Account – our TD Unlimited Business Plan is our most flexible banking plan and is perfect for businesses with high transactions or deposits. Get $100 rebate of the $149 Annual Fee for the first TD® Aeroplan®Visa* Business Card or TD Business Travel Visa Card.

2. We’ve got better business banking solutions.

Simplify the way you do business with a variety of great products and features:

- Access the funds you need, when you need them with a Business Line of Credit

- Easily manage your business expenses with a TD Business Travel Visa* Card and enjoy Free Overdraft Protection (through a $10 monthly fee rebate) with most Business Chequing Accounts2

- Explore our range of convenient ways to accept payments with TD Merchant Solutions

- Deposit cheques easily with TD Remote Deposit Capture

3. We’ve got your back with Experienced Advisors.

We have Advisors ready to help, so you can stay focused on doing your best.

Our knowledgeable and dedicated Advisors have a deep understanding of your industry and market, and will provide customized advice specific to your needs – every step of the way.

Your Account Manager might even come by your shop to understand your business better and see you in action!

4. We’re available when you need us.

Being your own boss comes with a lot of responsibilities, and you need a bank that works around your schedule.

- Longer Hours3 – we’re open later and longer so we can serve you better

- Open on Sunday3 – so you can do your banking with your other weekend errands

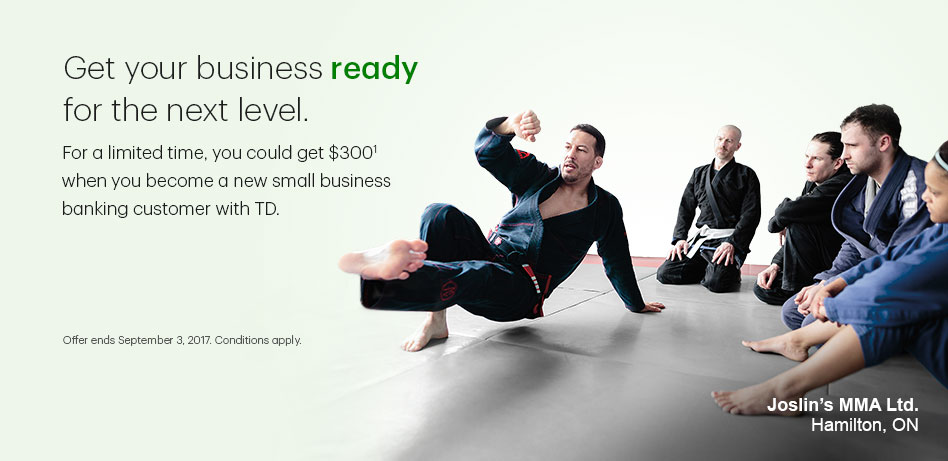

For a limited time, you could get $3001 when you become a new

small business banking customer with TD. Here’s how:

Personal banking customer? We’ve got a special offer for you too. Check it out.

PICK ONE

Open 1 of the following between June 15 and September 3, 2017

-OR-

PICK TWO

Apply for at least 2 of the following between June 15 and September 3, 2017

Business Line of Credit

or Business Loan

Apply for a Business Line of Credit with a minimum credit limit of $50,000, or a Business Loan with a minimum approved amount of $50,000 and a minimum one year term, made usable by November 17, 2017.

TD Remote

Deposit Capture

Apply for TD Remote Deposit Capture. If approved, use it by November 17, 2017, and discover a convenient way to deposit eligible cheques4 on your own schedule using your computer and compatible scanner.

TD Merchant Solutions

Be approved for a TD Merchant Solutions Account with a three-year term. Process at least one credit or debit card payment transaction with your TD Merchant Solutions payment solution by November 17, 2017. (TD Mobile POS, Temporary, Seasonal and National accounts are not eligible for this Offer.)

TD Business Credit Card

Apply for a new TD Aeroplan Visa* Business Card or a TD Business Travel Visa* Card. If approved, make a total of $1,000 in purchases by November 17, 2017, using your Card or any new Additional Cards issued to your business at your request.